In today’s defined contribution marketplace, the byword for many plans is simplification—reducing the choice “buildup” that has occurred over time while still providing access to options that can most readily capture the potential returns tied to diverse markets. Obviously, some nuance may be lost as the various ways to slice and dice a portfolio are abandoned by plan sponsors in an effort to encourage easier selection and, by extension, assist participants in creating more effective allocations. As a result, it is especially important that plan sponsors make their menu options count—nowhere more so than if they seek to provide exposure beyond the U.S.

Looking for Meaningful Diversification

How can a plan menu be structured to capture opportunities across the global equity universe? Many DC plans tend to have a home country bias when it comes to menu options—with plenty of domestic options but few overseas. According to a recent survey by the Plan Sponsor Council of America, the average DC plan offers six domestic equity options and only two international equity options. Even in their non-U.S. options, there is a temptation to include a global equity strategy as an easy way to capture U.S. as well as international exposure. Although appealing on its face, the downside is that such a choice tends to compound home country bias and create the potential for strategy overlap. We therefore feel it’s important to have a dedicated international option that’s distinct from the standard U.S. equity weightings that many investors view as the core of their portfolios.

Benefits of Active International Investing

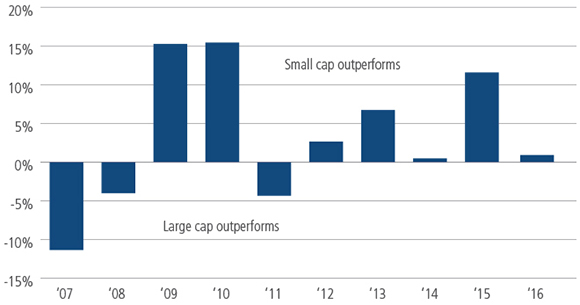

As part of menu simplification, many plan sponsors are carefully assessing whether to go with active or passive management in various market segments. A key consideration is the potential for alpha in relation to fees, which will often influence the allocation of a given strategy within a plan’s fee budget. Plans often provide passive options in a category where individual equities are well-researched and ample information flow arguably makes it difficult for active managers to gain an edge. In contrast, they may believe that it is easier to justify an active management option in a category where successful managers have generated meaningful outperformance versus their benchmarks. Figure 1 shows that international equity is just such a category: Top-quartile active managers in large cap international markets have provided greater excess returns than their U.S. counterparts over the past 26 years.

Figure 1: Active International Managers Can Make a Difference

Top Quartile Manager Average Excess Return, Rolling 5 Years (monthly), 1990-2016

Source: Morningstar Direct. Benchmarks are as follows: Foreign Large Blend, Growth and Value - MSCI EAFE Index; U.S. Large Blend - S&P 500; U.S. Large Growth - Russell 1000 Growth Index; U.S. Large Value - Russell 1000 Value Index.

Market-Cap and Style Flexibility Can Expand Opportunities

A major challenge in plan simplification is to reduce the number of investment options (to make selection by participants easier) while still providing access to the widest set of investment opportunities. In the international space, a plan could easily construct a menu with separate options for small-, mid- and large-cap investments, and growth and value managers. However, this would create multiple menu options, requiring participants to understand each, and how to allocate across them.

Within international equities, where options will likely be limited, our belief is that offering a single manager with flexibility across the style and capitalization ranges could make participants’ selection process easier. While delivering breadth across the asset class for the participant, a wider universe may also offer the manager opportunities to generate alpha. Smaller companies that are followed by fewer analysts, for example, may provide the potential for superior returns.

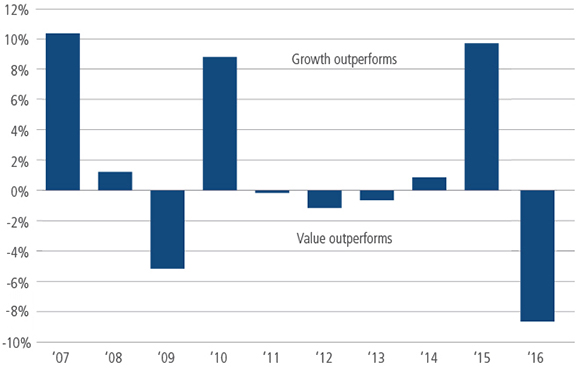

As shown in Figure 2, small-cap stocks have outperformed in recent years. However, small- and mid-caps have had periods of significant underperformance, so we believe that selectivity tied to valuation discipline and risk management is key in this area.

Figure 2: International Small Caps—An Appealing Source of Stocks

Annual Return Difference Between MSCI EAFE Small Capand EAFE Large Cap

Source: FactSet.

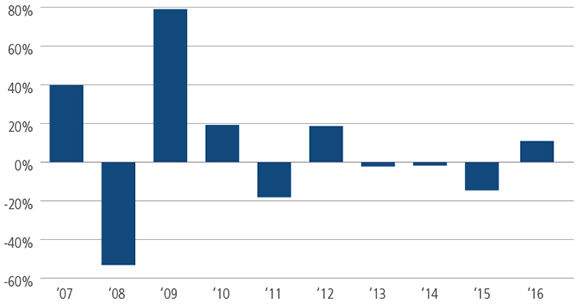

A similar point can be made with regard to style segments. As shown in Figure 3, the MSCI Growth and Value indices have tended to trade places, most recently with Value providing the stronger returns. Rather than leaving it up to participants to follow market cycles and allocate appropriately, we believe that employing a core investment approach that can draw on both segments may offer the potential to improve investment returns. In our view, combining flexibility on style and size may deliver superior returns, lower volatility and ease the burden on participants.

Figure 3: Growth and Value Have Traded Leadership

Annual Return Difference Between MSCI EAFE Growth and Value

Source: Morningstar Direct.

Capitalizing on M&A

Part of the appeal of smaller-cap stocks is that they can benefit from mergers and acquisitions (M&A) activity. M&A activity has been accelerating globally as many companies with large cash holdings struggle to grow revenues and look externally for growth. While much of the recent activity has centered on the U.S., we’re now seeing indications that it is picking up elsewhere, as a result of low interest rates, improved balance sheets and currency movements.

However, the benefits of M&A are not distributed evenly across companies. While the percentage of total transaction value is skewed to larger companies, the number of transactions is weighted toward smaller deals. For example, in 2016 there were USD 3.8 trillion worth of deals, but the average size of the transaction in the fourth quarter—which had the most M&A activity of the year—was just 289 million.1 It appears that purchasing smaller firms is believed to entail less risk for acquirers, contributing to their appeal as M&A targets.

A multi-cap international equity portfolio allows participants to benefit from the increasing level of corporate activity wherever it arises.

Accessing Emerging Markets through An International Strategy

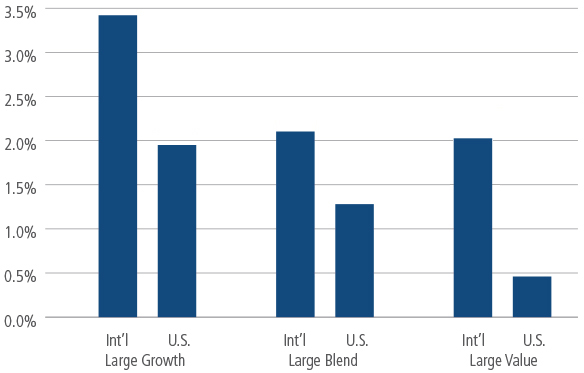

Another area that can provide opportunity for participants is emerging markets (EM) equity. While informed participants can allocate to dedicated EM managers at the right time, and are cognizant of the risks involved, for others a strategy that combines select exposure to this market segment within the context of an international portfolio may make sense. As with the style and size examples above, performance of EM relative to U.S. and international stocks has tended to go in cycles; consistent and/or managed participation in EM may help improve returns when EM is performing well, while managing risk when EM returns fade.

Figure 4: Emerging Markets’ Aggregate Returns Have Been Volatile

MSCI EM USD Returns

Source: Morningstar Direct.

In Dispersion, Focus on Fundamentals

For extended periods after the global financial crisis of 2008-2009, markets, countries and securities exhibited high correlations, as generally loose monetary policy and broad macro concerns dominated the markets. With monetary policies and growth rates now moving in more distinct paths, we believe that individual company fundamentals are becoming a more important driver of market performance, which should play to the strength of international managers focused on finding superior stocks.

In particular, we favor a quality orientation focused on high return (e.g., ROE, ROIC) companies that are generating attractive bottom-line growth with modest levels of debt. We believe that this approach is particularly well-suited to the current, generally slow economic environment, where earnings growth appears a likelier source of appreciation potential than multiple expansion. It also may capitalize on the M&A trend, as mid- and smaller-cap companies with solid balance sheets and businesses may be more attractive takeover candidates.

Quality and Risk Management

Mitigating downside risk is critical to participants’ ability to reach successful retirement outcomes. We believe that an investment approach focusing on quality allows participants to take part in up markets while managing exposure on the downside. This trend is apparent in the track record of low volatility international stocks, which have outperformed the broad EAFE index over the long term.

Figure 5: Lower Volatility Stocks Have Outperformed Over the Long Term

As of December 31, 2016

| Total Return (%) | Standard Deviation (%) | |||||||

|---|---|---|---|---|---|---|---|---|

| 1-Yr | 3-Yr | 5-Yr | 10-Yr | 1-Yr | 3-Yr | 5-Yr | 10-Yr | |

| MSCI EAFE Minimum Volatility | -1.43 | 3.90 | 8.02 | 4.19 | 10.40 | 10.11 | 10.52 | 13.26 |

| MSCI EAFE | 1.00 | -1.60 | 6.53 | 0.75 | 13.43 | 12.64 | 13.51 | 18.62 |

Source: Morningstar Direct.

Flexibility Can Support Simplicity

The notion of plan simplicity is a bit of a contradiction. The global economy is not simple, markets are not simple and the challenges faced by investment managers, plan sponsors and participants are not simple. And yet, for a defined contribution plan to succeed, the choices before a participant must be straightforward enough to avoid confusion, and more importantly, to prompt appropriate allocations that, over time, will lead to successful retirement investment outcomes.

In our view, a flexible, fundamental and active multi-cap approach to international equity investing offers many positives for participants in the current investment environment: It capitalizes on market dispersion. If quality-focused, it can help can help manage downside risk while providing capital appreciation potential. More specifically, it expands the international universe in a single investment option, enabling opportunistic investing within the widest possible investment universe, with the flexibility to be opportunistic regarding off-benchmark segments like small-caps and emerging markets. In sum, it offers the potential to distill the complexities of non-U.S. stocks into a single investment option that participants can understand and hold for the long term.

International Flexibility in DC Plans

| Question | Our Viewpoint | Rationale |

|---|---|---|

| Global vs. International | International | To limit home country bias |

| Active vs. Passive | Active | To take advantage of less efficient markets |

| Multiple Funds Across Market Caps vs. All-Cap Fund | All Cap | To avoid portfolio “clutter,” allocate effectively for participants, and capitalize on small-cap and M&A opportunities |

| Standalone Emerging Markets Fund vs. Include EM Exposure in International Fund | Include | Provide select allocation to volatile asset class |

| Quality vs. Growth or Value | Quality | Manage downside risk, enhance return potential in a retirement vehicle |

Source: Neuberger Berman.