As Defined Contribution (DC) plans have grown in both usage and size, employees have taken on increased responsibility for determining their savings rates and asset allocations while plan sponsors have struggled to help participants make better investment decisions. Over the years, plan sponsors have generally approached this challenge with a combination of participant education meetings and distribution of educational materials. While well intentioned, most of these efforts have not been viewed as widely successful, as participants remain overwhelmed, frustrated and generally disengaged from the allocation process.

As a new approach, some plan sponsors have begun to offer more simplified core investment menus. While the strategy has great potential for success, it may also have some drawbacks. In particular, simplification creates the possibility of excluding certain asset classes that arguably deserve their own discrete allocations. We believe that mid-cap equities are a key example, and in this short paper we examine both the simplification trend and the merits of providing a mid-cap equity plan option.

Shift toward Simplification

In most plans, the majority of participants build portfolios by selecting investments from the plan’s core menu. On average, such plans offer 19 investment options, making it hard for participants to decide where and how to invest. Behavioral research has shown that simplifying the plan investment menu can make it easier for participants to make investment choices. In many cases, plan sponsors have begun to simplify the number of investment offerings on their plan’s core menu with this in mind. Menu simplification varies by plan sponsor, but a common theme is to look to construct a menu with somewhere between 10 and 15 investment options. The list below shows an example of a simplified lineup.

Example of a Simplified Core Menu

| Large-cap U.S. equity | Small/mid-cap U.S. equity | International equity |

| Core bond | Real assets | Stable value or money market fund |

Where, in the past, the U.S. equity side of a DC plan menu was built around the nine “style boxes” (large, mid, small and growth, core, value), the practice of menu simplification suggests a reduction of the menu to a large-cap option and either a combined small cap/mid (or SMID) option or a small-cap option. While perhaps making it easier to make allocation decisions, this may result in the unintended consequence of a lack of exposure to either the larger mid-cap companies or to mid-caps generally.

Additionally, most menus now include a series of target date funds to meet the needs of participants looking for an investment allocation that is typically based on their projected retirement age and managed for them over time. Target date funds can vary in the underlying asset classes that make up the allocations; some are pre-packaged and some are custom-designed. In either case, plan sponsors may want to assess the exposure to mid-cap equities provided by the target date funds in their plan.

Understanding the Mid-Cap Gap

Why should plan sponsors be particularly concerned about such a mid-cap gap? As a starting point, it helps to know which equities are classified as mid-cap securities. Historical or more traditional definitions put most mid-cap stocks in the $2 – 5 billion, $2 – 10 billion or even $2 – 15 billion range, but the growth of the segment has increased the outer limit to nearly $30 billion. More specifically, the most recent reconstitution by Russell Investments set the Russell Midcap Index value within a range of $2.4 billion to $28.7 billion, as shown in Figure 1.1

Mid-Caps Represent a Substantial Asset Segment

Source: Russell Investments, as of May 29, 2015.

Although, in theory, large-cap managers may come down into the mid-cap range, and smaller managers may move up, in reality most such practitioners do not meaningfully cover what in our view is the “heart” of the mid-cap marketplace—a narrower segment consisting of companies with market capitalizations from $5 billion to $25 billion. As shown below, both the average small-cap equity fund and the average large-cap equity fund only hold a 17% allocation to this range. The average mid-cap manager holds a 65% allocation to the group. As such, plans that do not offer a dedicated mid-cap investment option may leave participants either without meaningful exposure to, or lacking effective diversification within, a group of companies that may contribute the growth they seek in order to reach a successful retirement outcome. These are typically companies that have matured out of the small-cap growth segment and, we believe, may often be on a trajectory to potentially become tomorrow’s large-cap leaders.

Gaining Exposure to the Mid-Cap Sweet Spot

Average Allocation to Companies in the $5 – 25B Market Cap Range within Lipper Category Averages

Source: FactSet, as of December 31, 2017.

In cases where larger- and smaller-cap managers may “drift” into the mid-cap space, we do not believe the result is a particularly attractive one. Most plan sponsors (or for that matter sophisticated investors generally) look for disciplined approaches to asset management, something that seems to conflict with haphazard extensions across capitalization ranges. In our view, managers who are exclusively focused on mid-caps are well positioned to capitalize on the best ideas to be found in this space.

Mining an “Overlooked” Asset Class

Missing out on exposure to mid-caps would not be much of an issue if the segment were poorly performing, or unattractive from a risk/return perspective. However, the reality is that mid-caps historically have provided strong performance, outperforming both large- and small-cap stocks on an absolute and risk-adjusted basis.

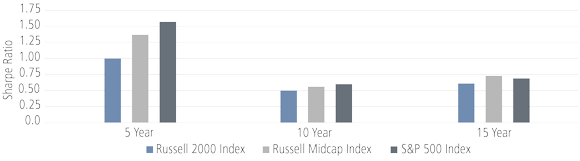

Mid-Caps’ Appealing Risk/Reward

Over time, mid-caps have delivered attractive risk-adjusted returns as reflected by the Sharpe ratio.

Source: Morningstar. Data through December 31, 2017.

In our view, mid-caps have done well for several reasons. Like large-caps, they are large enough to have strong fundamentals and established business models; like small-caps, they represent companies that have high growth potential, but mid-caps have the added advantage of being past the heightened operational and financial risks stage of small-caps. They have generally moved beyond the “all or nothing” binary event risk or narrow product lines associated with smaller companies, and have developed more mature methods of raising capital (through positive cash flows as well as debt and equity markets) that can contribute to improving balance sheet strength. Additionally, mid-caps typically have seasoned management teams that have successfully married their entrepreneurial spirit with the skills and discipline necessary to bring the business to the next level. Indeed, many standout companies and brands occupy the mid-cap universe, but are incorrectly assumed to be large-cap companies.

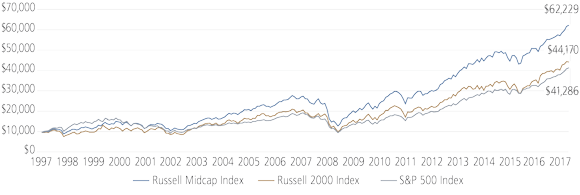

Mid-Cap Equities Have Provided a Performance Advantage

20-Year Growth of $10,000, 12/31/1997 – 12/31/2017

Source: Morningstar. Data through December 31, 2017.

Although mid-cap equities represent 26% of U.S. market capitalization, they often lack the broad Wall Street research coverage enjoyed by larger companies. For example, within the Russell Top 200 Index, which represents the 200 largest companies by market capitalization, each stock has an average of 24 analysts that provide a rating. By comparison, the Russell Midcap Index averages 14 analysts and the Russell 2000 Index averages just six.2 We believe the combination of more populated investable universes and generally less overall analyst coverage creates positive, inherent inefficiencies that afford active management and research greater opportunity to be impactful to performance through the early identification of underappreciated return catalysts and the development of non-consensus views.

Diversification is a typical goal for most participants. However, any investment menu simplification scheme that skews to large-caps may also result in unintended holding concentrations. Apple, for example, is currently the largest company by market capitalization and is owned by 4,444 open-end mutual funds, giving investors potential exposure across many active and passive investment strategies. Whether this is actually a negative depends on the future market performance of Apple (or other, similar examples), as well as each participant’s risk tolerance and investment objective. In our view, a dedicated allocation to mid-caps can help with diversification. How? By simply bringing new investment ideas into the mix and hopefully helping to boost participant diversification, at the holdings level, potentially alleviating the unintended consequences associated with an overall allocation built on investment strategies that are all beholden to the same subset of names. In contrast to Apple, Zoetis, Inc., which is currently the largest U.S. mid-cap stock,3 is held in only about 1,201 open-end mutual funds, and thus is less likely to appear across strategies held by an individual participant.

Making Menus Simple—and Smart

As plan sponsors simplify their menus it is important to make sure that the simplification has not left holes that may cause participants to miss out on opportunities in the market. The concept of DC plan menu simplification makes sense since research has shown that offering too many investment choices may lead to a reduction in plan participation and poor investment choices.4 However, as plan sponsors work toward a streamlined menu, they should keep asset class diversification as a priority goal.

In order to get full coverage of mid-cap equities, a DC plan menu may need to go beyond offering just large and small, or large and SMID managers, to cover the mid-cap segment. Given the sheer scale of the broadly defined mid-cap universe (more than 1,400 stocks), we believe it’s unrealistic to expect large-cap or small-cap managers to effectively and consistently capitalize on opportunities to be found in this space. Here, the size of the plan may play into the menu design. In the case of larger plans, mid-cap exposure may be accomplished by using multimanager or “white label” options that provide a way to bundle a number of managers together in a simplified format for selection by participants. For smaller plans that do not have the scale or resources to offer “white label” options, providing exposure to mid-cap securities may mean having an option for each capitalization range: large, mid and small.

Finally, plan sponsors should evaluate whether their target date fund option includes the appropriate allocation to mid-cap equities, as not all target date funds have the same level of asset class diversification.

Conclusion: Seeking Meaningful Diversification

Nine years after the financial crisis of 2008 – 09, risk management remains essential for participants as they look to achieve successful retirement outcomes. This is especially important in asset classes where they seek capital appreciation. Achieving true diversification is a key part of their challenge, but it is all the more difficult given the unintended redundancy that may occur in portfolios as many managers seek to gain exposure to the narrow band of mega-cap stocks that has largely driven equity performance over the last couple of years. Mid-cap managers mine a distinct segment of opportunities that can add to return potential without compounding this issue. In our view, mid-caps are as relevant as ever and deserve to be more than just an afterthought, but rather embraced for their own unique blend of risk and reward with a dedicated allocation within DC plan menus.