Corporate Hybrid Bond

A compelling investment opportunity in a rapidly growing market that includes high quality, non-financial, globally recognised and stable issuers offering attractive yields

- High quality, non-financial issuers in stable sectors—over 70% investment grade bonds, dominated by businesses with stable cash flows. Largest sectors are Utilities and Telecoms.

- Quality and Liquid: average rating of strategy is BBB, with focus on large and liquid issues and issuers, with opportunistic use of high yield-rated hybrids.

- Attractive Yield: corporate hybrid market has a highly attractive yield compared to senior IG bonds.

Key Risks

Market Risk: The risk of a change in the value of a position as a result of underlying market factors, including among other things, the overall performance of companies and the market perception of the global economy.

Liquidity Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Credit Risk: The risk that bond issuers may fail to meet their interest repayments, or repay debt, resulting in temporary or permanent losses to the portfolio.

Interest Rate Risk: The risk of interest rate movements affecting the value of fixed-rate bonds.

Derivatives Risk: The strategy may use certain types of financial derivative instruments (including certain complex instruments). This may increase the portfolio’s leverage significantly which may cause large variations in the value of investments. Investors should note that the strategy may achieve its investment objective by investing principally in Financial Derivative Instruments (FDI). There are certain investment risks that apply in relation to the use of FDI.

Emerging Markets Risk: Emerging markets are likely to bear higher risk due to a possible lack of adequate financial, legal, social, political and economic structures, protection and stability as well as uncertain tax positions which may lead to lower liquidity. The value of a portfolio may experience medium to high volatility due to lower liquidity and the availability of reliable information, as well as due to the strategy's investment policies or portfolio management techniques.

Counterparty Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Currency Risk: Investments in a currency other than the base currency of the portfolio are exposed to currency risk. Fluctuations in exchange rates may affect the return on investment. If the currency of the portfolio is different from your local currency, then you should be aware that due to exchange rate fluctuations the performance may increase or decrease if converted into your local currency.

Overview

What are Corporate Hybrid Bonds?

- Corporate Hybrid Bonds combine features of both debt and equity securities

- They are long-dated, callable, subordinated bonds with flexible coupons

- Coupons are flexible but cumulative, the issuer cannot pay equity dividends or otherwise return capital to shareholders until the missed coupons are met, and often, interest on top as well

- Issuers have a very strong incentive to call the bond at the first call date

Why Corporate Hybrid Bonds?

A high quality asset class providing attractive returns

- Very strong, globally recognized investment grade issuers

- Yields are significantly higher than those on senior bonds of the same issuers

- High yield-like returns from strong, generally well-known, investment grade entities

- Bonds are included in the major fixed income indices. Liquidity is strong and interest in the sector is building

- Increasing issuance from broad range of large, listed, non-financial, high quality companies

Investment Philosophy

We implement what can best be described as a fundamental, opportunistic, value-based investment philosophy that focuses on identifying and capitalising on relative value opportunities within the corporate hybrid investment universe.

We believe that consistent attractive returns are the result of investment insight and judgment applied to portfolios in a risk-controlled framework. Our experienced portfolio management team gains insights through proprietary fundamental research conducted within the framework of a disciplined investment process. We are a value manager that seeks to extract mispricings from the market without exposing our portfolios to permanent or persistent tilts or biases based on macro-thematic or other theses. We believe it is possible to extract relative value from credit markets throughout a market cycle.

Keys to success include:

- Fundamental and disciplined approach;

- Internally generated and practical research;

- Long term investment horizon;

- Low portfolio turnover;

- Patient and opportunistic investing mindset;

- An experienced team of highly skilled investment professionals;

- Every security put into portfolio should be compelling from a valuation perspective.

Risk management is an important element of our philosophy. We seek to achieve client objectives using multiple strategies, and we have developed proprietary systems that enable us to manage risk consistent with client objectives and constraints. We seek to minimize individual issuer credit risk through high diversification.

Investment Process

Dedicated Investment grade credit team focusing on in-depth knowledge of issuers, hybrid structures and security valuation

Our team seeks to identify attractive, high conviction investment ideas based on intensive fundamental analysis, in combination with a relative value focused framework

Proactive process that is disciplined and repeatable

-

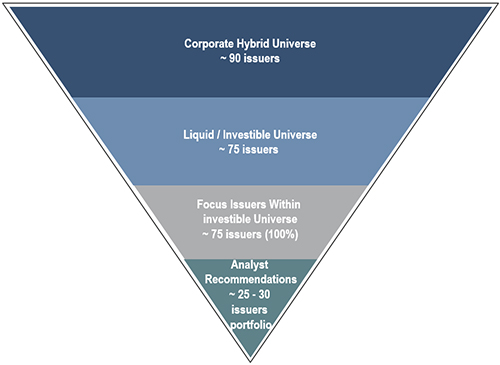

Universe

Start with Hybrid Universe. -

Liquid / Investible Universe

Limit research on illiquid issuers to informational.- Cash flow generation / predictability

- Event risk analysis

-

Focus Issuers

Analysts are responsible for in-depth analysis for key issuers and for understanding structure and valuation. -

Analyst Recommendations

About half of the positions are meaningful overweight's.

| Credit | Hybrid Structure | Relative Valuation |

|---|---|---|

1. View on the issuer and its future credit trend, including the strategic rationale for hybrid issuance |

2. Hybrid structure and its implied potential valuation downside? |

3. Assessing the relative value positioning of the hybrid instruments? |

|

|

|

Source: Neuberger Berman Europe Limited. For illustrative purposes only