Who We Are

Neuberger Berman was founded in 1939 to do one thing: deliver compelling investment results for our clients over the long term. This remains our singular purpose today, driven by a culture rooted in deep fundamental research, the pursuit of investment insight and continuous innovation on behalf of clients, and facilitated by the free exchange of ideas across the organization.

From offices in 40 cities across 27 countries, Neuberger Berman manages a range of equity, fixed income, private equity and hedge fund strategies on behalf of institutions, advisors and individual investors worldwide. With 779 investment professionals and 2,922 employees in total, Neuberger Berman has built a diverse team of individuals united in their commitment to client outcomes and investment excellence. Our culture has afforded us enviable retention rates among our senior investment staff, and has earned us citations as first or second (among those with 1,000 or more employees) in the Pensions & Investments “Best Places to Work in Money Management” survey each year since 2014.

As a private, independent, employee-owned investment manager, Neuberger Berman is structurally aligned with the long-term interests of our clients. We have no external parent or public shareholders to serve, nor other lines of business to distract us from our core mission. And with our employees and their families invested alongside our clients—plus 100% of employee deferred cash compensation directly linked to team and firm strategies—we are truly in this together.

George H. Walker

Chairman & CEO

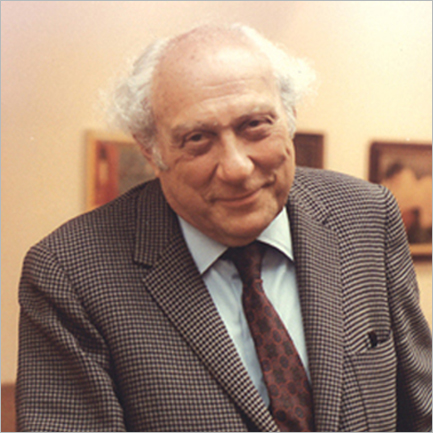

When Roy Neuberger started collecting art in 1939, he bought pieces that spoke to him. “I buy because I love the work,” he said. The fact that many of his favorite artists—like Jackson Pollock, Edward Hopper and especially Milton Avery—went on to become household names is a testament to his unique insight. In art, as in investment, Roy didn’t follow the market—the market followed him.

At the firm he founded in that same year of 1939, we try to live up to those principles. We value experience but have an eye for innovation. Our culture is strong; our teams are independent. Company fundamentals and client objectives are what drive us, not the noise of the markets. That is the art of investing, the art of partnership, the art of service.

Neuberger Berman is a private, independent, employee-owned investment manager—a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

We believe that our 100% independent, employee ownership and singular business focus best aligns us—both as an organization and as individuals—with the long-term interests of our clients. With no external parent or public shareholders to serve, we are empowered to run our business with a lasting, client-centric perspective. With no proprietary trading or market-making operations, we are able to concentrate our efforts solely on our core activity of investment management. And with our employees and their families having significant personal capital invested alongside that of our clients—plus 100% of employee deferred cash compensation directly linked to team and firm strategies—we are truly in this together.

100%

Independent, employee-owned2

100%

Deferred cash compensation directly linked to team and firm strategies

We are passionate, independent investors united by our commitment to research-driven investment solutions and client service. With 779 investment professionals based in 22 portfolio management centers, we offer clients around the world investment solutions across asset classes, capitalizations, styles and geographies in both public and private markets, as well as multi-asset class solutions that bring them all together. To serve this broad base of institutions, advisors and individuals, our strategies are available through a variety of investment vehicles.

Ultimately we are judged on our ability to deliver risk-adjusted returns to clients over time, and we stand by our record as a testament to the prowess of our investment professionals and the strength of our firm culture.

In this edition of the Annual Report, we explore how we are positioning the firm to thrive in a changing world and economic order.

As a private, independent, employee-owned investment manager, Neuberger Berman has the freedom to focus exclusively on investing for our clients for the long term. As such, we are deeply attuned to each client’s unique combination of investment goals, risk tolerance, and income and liquidity requirements, and we can act in partnership to address them as they change over time.

Inherent in this culture of partnership is a commitment to innovation, a firm-wide drive to uncover new solutions as markets and client needs evolve. Not merely innovation for its own sake, but rather the development of transformative concepts rooted in practical client applications. Since 1939 we have been on the forefront of a number of industry trends now considered commonplace—from the launch of one of the first no-load funds to the early adoption of socially responsive investment techniques.

Our commitment extends beyond our lineup of investment products. We look to collaborate with clients to overcome a variety of challenges, be it a corporate pension plan trying to better match assets and liabilities or an investment advisor interested in evolving their practice. We are proud to be a thought partner to our clients, offering access to our investment professionals, both in person and through our thought leadership publications, training and joint research projects.

Our portfolio management professionals are critical, independent thinkers who benefit from being part of a global, diverse investment organization composed of 779 investment professionals with different perspectives on markets, economies and strategies. Clients benefit from the firm’s intellectual capital across investment disciplines—equity and credit, public and private, long and short, large and small—as our breadth of perspective bolsters individual conviction and often results in portfolios with high active shares and the potential for alpha generation.

We continue to value the free exchange of ideas in pursuit of insight that might otherwise go undiscovered. We host multiple forums in which our investment professionals can share research, test theories and expose to scrutiny their investment ideas. These include both formal assemblies—such as our various asset class investment committees and the cross-class Asset Allocation Committee, along with our various research teams—as well as informal connections initiated by like-minded professionals with a shared dedication to the pursuit of investment insight on behalf of clients.