US Small Cap Intrinsic Value

A research-intensive strategy that seeks to identify small-cap companies trading at a significant discount to their long-term value with an identifiable catalyst to help narrow the value/price gap over time

- Employs a private equity-style analysis with a long-term investment horizon

- Seeks to exploit recurring market inefficiencies due to limited analyst coverage and investor impatience with complex, cyclical and interrupted growth companies

- Run by the portfolio manager who launched the product in 1997, supported by a seasoned team of specialized small-cap research analysts who, collectively, have navigated through numerous market cycles

Key Risks

Market Risk: The risk of a change in the value of a position as a result of underlying market factors, including among other things, the overall performance of companies and the market perception of the global economy.

Liquidity Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Smaller Companies Risk: In respect of portfolios which may invest in small capitalisation companies, such investments involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of small size, limited markets and financial resources, narrow product lines and a frequent lack of depth of management.

Counterparty Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Currency Risk: Investments in a currency other than the base currency of the portfolio are exposed to currency risk. Fluctuations in exchange rates may affect the return on investment. If the currency of the portfolio is different from your local currency, then you should be aware that due to exchange rate fluctuations the performance may increase or decrease if converted into your local currency.

Overview

Investment Philosophy

Our investment philosophy is built upon three pillars:

INDEPENDENCE

Conventional wisdom yields conventional returns

- As contrarians, we think differently focusing on underperforming and out-of-favor sectors and companies

- Small-cap stocks typically have less analyst research coverage and greater uncertainty as to profitability

VALUE

Earnings, assets and cash flow create shareholder wealth

- We implement a private equity-style approach that employs an extensive financial tool set to establish intrinsic value estimates

- Higher insider ownership of small-cap companies aligns management incentives with shareholders' interests

CATALYST

Creative forward thinking

- Anticipating change can enhance value

- Small companies tend to be acquired more frequently than larger companies and for higher premiums

Investment Process

We use fundamental analysis and bottom-up stock picking in a multi-step process.

We identify potential investment candidates through screening publicly traded small-cap stocks with $200 million to $5 billion in market capitalization for price underperformance and other characteristics we find attractive.

Value assessed through "private equity"-like analysis using three primary tools – cash flow analysis, theoretical earnings based on peer group returns on invested capital and recent merger and acquisition multiples. The objective is to identify companies selling at a 30% discount to our estimate of intrinsic value.

We not only seek to buy stocks at a material discount to their estimated intrinsic value, but also try to anticipate fundamental corporate changes that can enhance value, such as a merger, liquidation, spin-off, management change, share repurchase and/or other catalyst.

Portfolios are diversified across sectors and individual security holdings and weightings are a by-product of our bottom-up investment process and depend on our market outlook.

Investment Themes

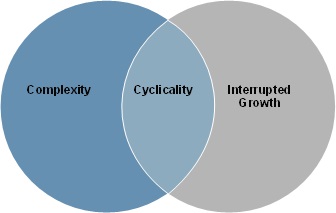

We have identified recurring market inefficiencies and frequently find opportunities among companies with complex corporate structures, cyclical business and growing franchises whose growth has been temporarily interrupted.

- Cyclicality: Investors tend to avoid cyclical companies during downturns

- Complexity: Investors tend to undervalue diverse, complicated companies

- Interrupted Growth: Investors tend to undervalue small companies during periods of stalled or slowing growth