Global High Yield

A disciplined credit process led by one of the largest dedicated global non-investment grade credit teams located across 3 continents

- Five sources of added value: avoidance of credit deterioration, relative value analysis, sector rotation, country selection and allocation between U.S., Europe and Emerging Markets.

- Comprehensive credit analysis driven by proprietary “Credit Best Practices” with a risk management overlay and ESG framework

- Global Coverage with Local Presence: the portfolio managers are based in Chicago, Atlanta, London, The Hague and Singapore.

- Disciplined and repeatable process managed by an experienced and stable investment team leveraging 200+ fixed income professionals

Key Risks

Market Risk: The risk of a change in the value of a position as a result of underlying market factors, including among other things, the overall performance of companies and the market perception of the global economy.

Liquidity Risk: The risk that the Fund may be unable to sell an investment readily at its fair market value. In extreme market conditions this can affect the Fund’s ability to meet redemption requests upon demand.

Emerging Markets Risk: Emerging markets are likely to bear higher risk due to a possible lack of adequate financial, legal, social, political and economic structures, protection and stability as well as uncertain tax positions which may lead to lower liquidity. The NAV of the fund may experience medium to high volatility due to lower liquidity and the availability of reliable information, as well as due to the fund's investment policies or portfolio management techniques.

Credit Risk: The risk that bond issuers may fail to meet their interest repayments, or repay debt, resulting in temporary or permanent losses to the Fund.

Interest Rate Risk: The risk of interest rate movements affecting the value of fixed-rate bonds.

Counterparty Risk: The risk that a counterparty will not fulfil its payment obligation for a trade, contract or other transaction, on the due date.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Currency Risk: Investors who subscribe in a currency other than the base currency of the Fund are exposed to currency risk. Fluctuations in exchange rates may affect the return on investment. The past performance shown is based on the share class to which this factsheet relates. If the currency of this share class is different from your local currency, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency.

Overview

Investment Philosophy

We believe:

- A disciplined credit process that focuses on attractive relative value opportunities while avoiding credit deterioration

- Inherent volatility in high-yield markets can provide experienced managers with compelling relative value opportunities

- Risk management is key to successful high-yield investing

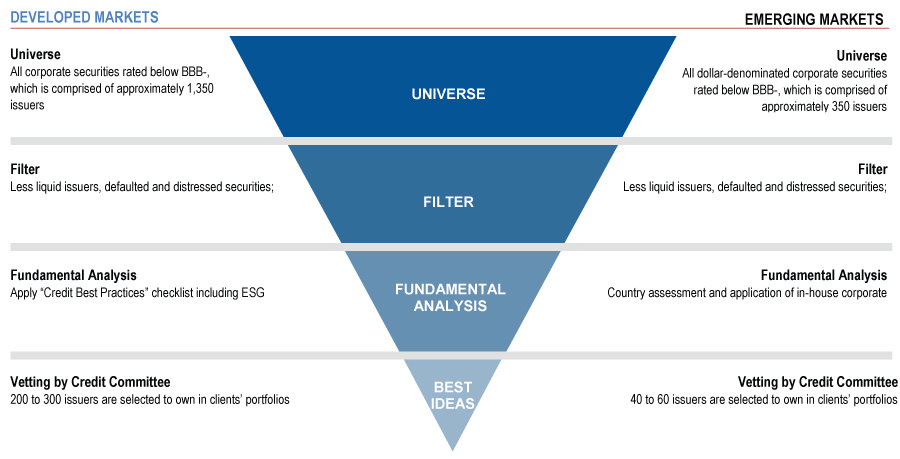

Investment Process

Disciplined process that uses a proprietary “Credit Best Practices” Checklist with a risk management overlay and an ESG framework.

Our credit analysis capabilities are complemented with a technology-driven set of proprietary analytical processes to identify, select and monitor portfolio positions. We leverage a customized database containing detailed information on over 2,000 global credits. We typically select 200 – 300 issuers to own in the strategy.

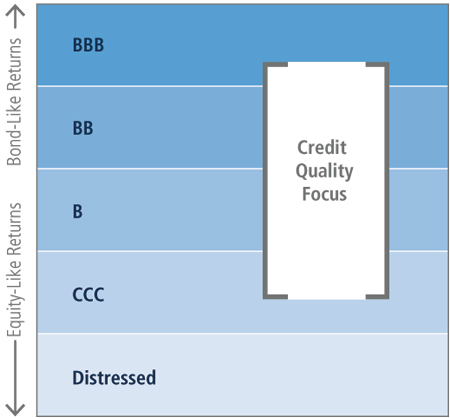

Quality Objective

We focus on B and BB large and liquid issuers, with opportunistic use of BBB and CCC credit tiers, avoiding distressed issuers. Portfolios are customized to meet client guidelines.