Investment Strategies

>

NorthBound Equity Partners Platform

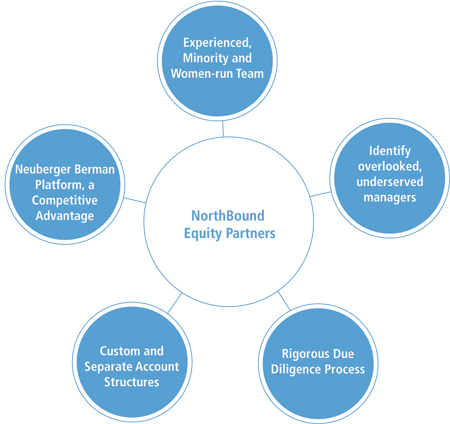

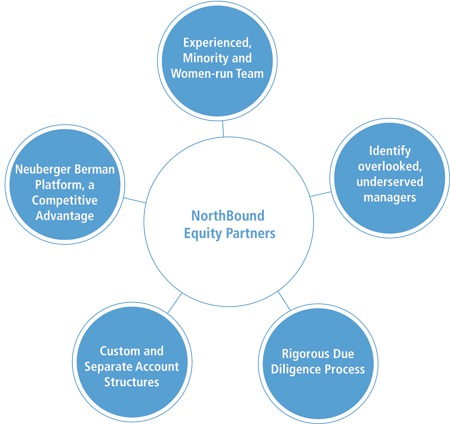

NorthBound Equity Partners Platform

NorthBound makes highly selective investments in private equity emerging managers

- Seeks to build diversified and attractive portfolios of private equity investments across fund, equity co-investments and private debt investments

- Partner with overlooked and underserved emerging managers

- Minority and woman-owned funds

- Funds under $1 billion

- First and second time funds

Patricia Miller Zollar

Overview

Neuberger Berman Private Equity Advantages

Seeking emerging managers with:

- Demonstrated track record of successful investing with identifiable edge

- High degree of aligned interests

- Focus on smaller businesses that are attractively priced

- Conservative capital structures

- Expertise in transforming businesses in which they invest

- Ability to capitalize on and cultivate demographic changes

Extensive knowledge of the market

- Identified over 350 managers that are run by women and minorities

- Broad and diverse network; our history in the emerging manager space generates large deal flow

- NB Private Equity platform provides for comprehensive due diligence and sourcing capabilities

Highly selective across strategies

- Employ well balanced and diversified portfolio construction

- Allocations to generalist buyout, industry focused buyout and distressed/turnaround funds

- Overweight highest conviction managers

Unique insight and perspective

- The NorthBound Investment Committee’s members have a wide range of expertise and experience in the private equity marketplace

Investing Capabilities

The team will invest in emerging manager funds, equity co-investments and private debt investments. Our investment philosophy is as follows:

Management

Patricia Miller Zollar

Head of NorthBound Equity Partners

39

Years of Industry Experience

32

Years with Neuberger Berman