Recently, Yan Taw (YT) Boon was in rural China, where he tried to purchase a soda from a local mom-and-pop store. To his surprise, the 80-year-old shopkeeper refused to accept his cash, insisting that he use Tenpay, which is a Chinese mobile payment app. Despite her claim that “Everybody has Tenpay!”, the Neuberger Berman tech analyst did not (as the app is not commonly used in Hong Kong, where he lives), and he was forced to ask a local acquaintance to pay for his drink. Later, he learned that most of his friends in China hadn’t used cash for at least a year, given the gravitation toward mobile/online payment.

This anecdote, which says something about the popularity of “fintech” (it is far-reaching in emerging markets), is probably even more significant in highlighting the ways in which technology is insinuating itself into our lives and activities, from the most basic (buying a soda) to the more complex (keeping calendars, managing relationships, driving a car), and turning upside down prevalent relationships and practices in the process.

It’s not that progress is new. Innovations have come at a furious pace in recent decades, whether with the rise of the semiconductor, the growth of the personal computer, or the explosion of the internet and “all things digital” in the 1990s and early 2000s. But now, there’s something tangibly different about the degree to which technology is becoming intertwined in human affairs.

“At a very high level, I feel we are in an early stage of fundamental changes to how the world works,” observes Hari Srinivasan, who also covers tech for Neuberger Berman’s equity research team. In the industrial revolution, the steam engine and other machines stepped in to augment humans’ physical power. We are entering an age in which the physical economy is giving way to a digital economy in which thinking machines are becoming increasingly viable.

Disruption Is Accelerating

84% of executives surveyed believe their industry has reached a point of disruption or will within the next few years.

Source: Harvard Business Review, 2016.

Technological innovation often accelerates in challenging times, and, in Srinivasan’s view, the current surge has its roots in the financial crisis of 2008, during and after which many companies doubled down on tech as a way to cut costs. With the rebound in the economy, their focus continued as a way to maintain and raise profitability, create new products and invade other business sectors. The current efforts have coincided with the rapid decline of computing costs, combined with the maturation of four key building blocks of innovation: the cloud, social platforms, mobile and analytics.

Digital Drivers

The cloud has served as an engine for refashioning and introducing new services for consumers, as well as for rethinking the practices of businesses, large and small. The ability to leverage outside digital infrastructure produces major cost savings to existing players and allows startups to act bigger than they are. Meanwhile, native cloud-based providers have been able to create services that aren’t dragged down by legacy systems.

Social platforms that have revolutionized the structure of social interaction have also created an advertising goldmine, changing the way companies interact with consumers and enhancing their ability to create very finely tuned messages calibrated to generate a specific response or action, or to reinforce and encourage certain consumer behavior.

Mobile: Today, nearly everyone travels around with a tracking device known as a cell phone. Myriad apps open up nearly limitless opportunities for enterprising developers, who provide services ranging from the frivolous to potentially essential. The communications provided through apps, e-mail and telephony are a marketer’s dream.

Analytics: All of the elements above contribute to the vast treasure trove of data that companies are only beginning to leverage. (Read more about Big Data here.)

E-commerce Continues to Gain Market Share

Source: U.S. Department of Commerce.

The combined impact of these and other advances has been sweeping, fundamentally altering the way companies seek to make money. For example, major web-based providers like Google can offer software and other products for free, monetizing them through the use of advertising, which leaves more traditional providers with limited means to compete. And Amazon uses its online product sales to support its more lucrative businesses of cloud and third-party services, as well as advances into logical business extensions, like groceries. Meanwhile, its broad geographic reach, low prices and virtually unlimited inventory make life very difficult for brick-and-mortar retailers.

More broadly, we are seeing an advancing digitization of the corporate world, as companies are continually reassessing their practices and business models. Product development, for example, has historically been an arduous process. Firms developed a prototype, had meetings with customers, made adjustments and repeated the process until they felt confident enough for a release. Now, in some cases, companies may release a product on their consumer website, adapt it based on posted comments, and iterate until the kinks are removed. Or they may draw on social media fan pages to assess demand and receive feedback at an early stage.

Digital interaction allows companies to have a far more intimate relationship with customers. At point of sale, they can recommend items that complement a purchase (think spaghetti and spaghetti sauce), add coupon enticements or draw potential buyers into other areas of shopping interest. An active social media presence strengthens their ties to consumers and can protect the brand. For example, when a plane flight is cancelled, staff that monitors social media will react quickly to irate travelers’ posts. E-mail and chat are a lot cheaper than a phone call, and they can often provide a higher level of service.

Social Media Has Intensified Interaction With Customers

Percent of all American adults and internet-using adults who use at least one social networking site.

Source: Pew Research Center surveys, 2005-2006, 2008-2015. No data are available for 2007.

The changes are not just in the realm of internet, retail and consumer businesses. In manufacturing, digital approaches have provided for unprecedented transparency across the whole supply chain, and allowed for interaction that is far more collaborative, efficient and adaptable—for example reacting to issues such as supply disruptions of a particular product or changes in customer demand. That’s not even going into the advances in systems, robotics, wireless and 3D printing, which have altered factory and assembly floors across industries (see “Disruption: An Industry Sampling” below).

Disruption: An Industry Sampling

Retail: Web-based competition is decimating much of the brick-and-mortar retail sector, with some 50 major bankruptcies and 7,000 store closings in the U.S. during 2017.* Luxury-oriented companies and those that can navigate an effective digital/traditional mix likely have a better chance of survival.

Automobiles: Arguably the epicenter of disruption as electrification, ride-sharing and automation combine to potentially remake how we interact with cars on a daily basis. Major players are busy testing autonomous cars and gathering data to improve decision making.

Energy: Use of big data and other tech innovations have helped North American shale producers become low-cost sustainable production powerhouses. This has changed the flow of commodities around the world and pressured more challenged, higher-cost energy producers that are dependent on oil and gas for revenues. The spread of electric vehicles could stress global power grids, leading to more natural gas-fired power plants.

Health Care: Recent proposed mergers reflect the melding of various components of the health care sector, which is becoming increasingly “high touch.” Expect more digital health apps and tools, aided by artificial intelligence capabilities, to complement the traditional doctor/patient relationship, although regulators will ensure that widespread adoption occurs at a measured pace.

Finance: Bitcoin, the volatile cryptocurrency, has grown more popular; recently, Bitcoin futures started trading in the U.S. Other innovations such as payment apps, robo-advisors and online lenders are also gaining traction—particularly in regions of the world with less existing financial infrastructure.

If trends weren’t already fluid, the specter of artificial intelligence has introduced new potential (and some anxiety) to the business and personal landscape. “AI” is not a new concept, and has been a research focus since World War II, as experts have tried to imitate and improve upon processes of human thought. However, thinking machines didn’t become a tangible possibility until silicon-chip-driven processing speeds accelerated and data became more plentiful—first with the advent of the internet and later with the spread of mobile phones. AI is appearing incrementally in smart apps for homes, retail websites, fintech applications and the broad trend of the “internet of things.” And it is a key building block in the autonomous car revolution and the future of robotics, whether for factories, retail or business use. Familiar large tech names dominate AI capabilities today, but YT Boon, who has studied the area extensively, thinks it’s likely that major players in health care, finance and other industries will become more active given the extensive proprietary data they control.

There is much work to be done on the AI and robotics front. Machines are very good at repetitive tasks, but are far more challenged when it comes to dealing with the random variables that the human brain has become accustomed to. (Picking different items from a bin is still a major challenge.) Moreover, even though considerable data has been accumulated, much more is needed, particularly in autonomous driving, where the world literally needs to be mapped, and you see infinite variables such as weather, road repairs, poor drivers and the like.

Says Boon, “We are still in early days.”

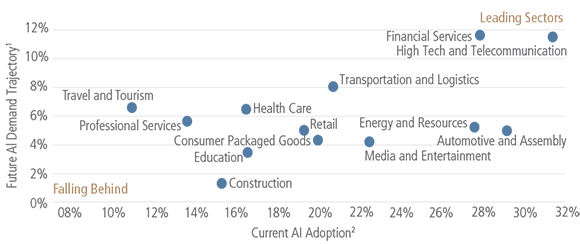

Sectors Leading AI Adoption Plan to Continue Spending

Source: McKinsey Global Institute AI adoption and use survey, June 2017.

1Average estimated percent change in AI spending, next 3 years, weighted by firm size.

2Percent of firm adopting one or more AI technology at scale or in a core part of their business, weighted by firm size.

Portfolios: Mining for—and Avoiding—Disruption

With all the changes, a key challenge for portfolio managers is how to bring disruption into their game plan, whether to capitalize on opportunities or to mitigate downside risks.

A few years ago, alarm bells went off for Elias Cohen, tech analyst and portfolio manager for Neuberger Berman’s Global Equity team, when he attended a conference on “business intelligence.” The upshot was that technology was moving from a back-office driver of cost savings to an existential game changer and revenue driver. He came back and argued to colleagues that they needed to ask every company, no matter what the sector, what their digital strategy was—a practice that they adopted and continue today.

For Cohen, in the context of the team’s quality-at-a-reasonable-price discipline, the primary goal is fairly simple: avoid the “disruptees” and invest in disruptors or companies that won’t be victims of the disruption. “What I’m concerned about, first and foremost, is avoiding the things that can get disrupted and blow up.” He can rattle off various sectors that at one point might have been attractive but have been left in the dust by disruptors: for example, advertising agencies obviated by the dominance of Facebook and Google online ad dollars (80% market share), traditional retailers crushed by pressure from online sellers, and publishers, who were among the first victims of the internet monsoon.

A common tipoff, in his view, is when customers are overserved—provided with services that they like but might do without at a lower price. Town cars or even taxis may offer a better experience than an Uber, but the latter is typically cheaper and probably “good enough,” while bringing more customers into the mix.

The fact that a disrupted company has a low valuation doesn’t necessarily matter. “The threat of value traps is so much greater than it has ever been before,” says Cohen. “When value is the only component of your investment case, and the company doesn’t have that clear path out, then for me that’s an uninvestable signal—because the franchise will likely keep eroding.”

Traditional firms should understand that, even if their business has not yet been affected, there may be potential disruptors out there that apply different rules of engagement, or are incentivized in different ways. In assessing their prospects, an investor should consider whether existing players are taking proactive, thoughtful steps to counter threats and remain viable. Use of data is often critical, observes Srinivasan. In consumer sectors, for example, companies that employ data effectively can better understand who visits their websites, what interests them and how they can be engaged, and then draw on that data to build stronger customer relationships. Contrast that with local TV broadcasters who historically had very primitive information on viewers, making their advertising decisions and measurement a bit of a guessing game.

Gauging Opportunities

Taking a structured approach to assessing change is important. Rick Bradt and Jason Tauber, portfolio managers for Neuberger Berman’s Disrupters Portfolio, build their efforts around identifying “optionality” in companies that is not reflected in market expectations. For example, a company that creates and masters enabling technology for one application may have an opportunity to apply the technology elsewhere (e.g., the use of video gaming architecture for autonomous driving and artificial intelligence). The more potential avenues there are for the product, the greater the potential upside for investors. This means that you can worry less about smaller fundamental issues in the current core business and focus more on the larger opportunity set, says Bradt. It also means that a traditional 12-month price/earnings approach to assessing valuation may be a bit shortsighted.

That said, “FANG” and other well-known tech stocks are already recognized and valued for their revenue growth. Srinivasan often argues for “investing in the platform”—looking to industry leaders that have developed self-reinforcing platforms that leverage both their user base and product offerings to grow revenues. However, he emphasizes that given high valuations, waiting for attractive entry points can be a good approach.

More generally, a selective value investor who’s willing to spend time to understand tech disruptions should still be able to find potential bargains in the current landscape. Some companies that appear to be disrupted may be far more resilient than most investors expect, says Amit Solomon, research analyst and portfolio manager for Neuberger Berman’s Intrinsic Value team. This happened, for example, when a leading telecommunications company roiled the telecom equipment industry a few years ago in its move away from networking hardware to software. The change jostled existing suppliers, but provided opportunities for some nimble smaller suppliers that adjusted quickly to the new landscape, as well as for service providers who could help support the telecom company’s and other carriers’ hardware-to-software transition.

In the autos space, the trend of autonomous driving is accelerating demand for advanced components such as electronic chips and sensors. At the same time, Solomon anticipates that sharing platforms could gradually curtail growth in the number of vehicles produced, suggesting that companies benefiting from rapid content growth in vehicles could be preferable to those simply exposed to auto manufacturing volumes.

Even companies making disrupted products that could gradually become obsolete may present an opportunity at the right price. Many of these companies offer strong cash yields from their existing products that can be returned to shareholders or used to grow new businesses.

Finally, it’s worth remembering that a “disruptive” company won’t necessarily be successful. For instance, the market for meal kit delivery has been growing, but low barriers to entry, high “churn” and steep customer acquisition costs have made it a difficult area in which to invest. “There are plenty of examples like that,” says Tauber. “It’s not just having the disruption alone but having something that ultimately can be a large and defensible business.”

Taking a Step Back

In our view, disruption trends merit a fresh assessment of portfolios. Just as portfolio managers may ask visiting companies about tech-related concerns, clients can ask their managers about tech risks and opportunities tied to holdings, as well as whether the managers are able to utilize new tools, such as data analysis, that can enhance the investment decision-making process and the ability to generate returns.

Importantly, it is becoming more difficult to categorize “technology” as a distinct market sector. Yes, many tech firms specialize in providing software, hardware and consulting to traditional players, but many are increasingly applying their core competencies to new areas—not only affecting those they seek to disrupt, but complicating the tasks of portfolio diversification and risk management as they catalyze creative destruction across industries.

Another factor that’s harder to quantify (but worth thinking about) is the larger economic impacts of tech disruption. If you read the newspapers, AI and other transformative technologies could create major shifts in employment, geographic concentration and income strata on a global basis. However, the contours of these trends are still quite vague and—bleak scenarios aside—innovations throughout history have often created new types of work and new industries that few would have even contemplated a few years earlier.

In sum, we believe technological change and disruption should be considered across the spectrum of investment research, from micro to macro. It should also play a role in portfolio analysis and strategy, given its potentially significant impact on performance over the long term.