Investment Strategies

>

Municipal Impact Strategy

Municipal Impact Strategy

Active, research driven managers with a deep understanding of municipal bond industry dynamics

- For decades, Neuberger Berman has managed municipal bond portfolios for institutions, individual clients and families, today totaling approximately $11 billion in assets1

- We maintain a network of over 100 regional broker/dealer relationships that provide us with access to robust deal flow

- The team has 11 seasoned investment professionals1 with extensive experience in the municipal marketplace

James L. Iselin

Senior Portfolio Manager and Head of Municipal Fixed Income

Blake Miller, CFA

Senior Portfolio Manager

Jeffrey Hunn

Overview

Investment Philosophy

- Principal preservation is our primary goal

- We believe that security selection drives returns

- Rigorous credit process is embedded in all aspects of portfolio management

- Individual client objectives determine portfolio construction

Invest in Projects Across Social and Environmental Themes

| Social | Environmental | |

|---|---|---|

Themes |

|

|

Project Examples |

|

|

|

||

Target positive outcomes to support economically, socially, and environmentally sustainable communities across the U.S. |

||

Investment Process

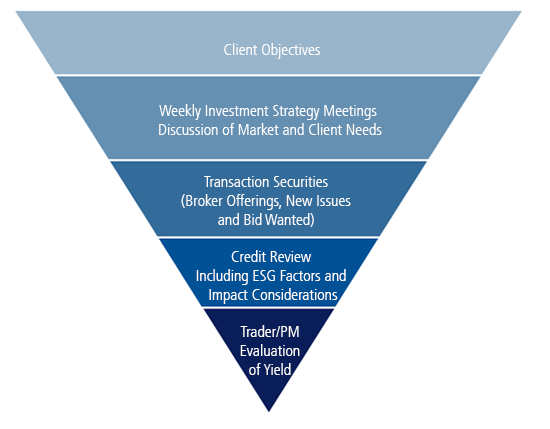

Proven process to achieve clients’ objectives and deliver competitive returns and positive social and environmental impact

Aligning Strategy With Clients’ Objectives

Security decisions are driven by:

- Guidelines

- Credit risk

- Liquidity needs

- Concentration risk

- Interest rate risk

- Sector bias

- Analyze ESG material factors & Impact considerations

- Regulator and capital considerations for financial/institutional clients

- Marginal tax rate

Impact is an integrated part of the investment process – from security selection, managed post-purchase and reporting | ||

|---|---|---|

|

||

|

|

|

| ◄-------------------------------------------------------------------- | Sustainable Issuer Social or Environmental Use of Proceeds Place-Based Potential for Impact |

---------------------------------------------------------------------► |

Management

James L. Iselin

Senior Portfolio Manager and Head of Municipal Fixed Income

32

Years of Industry Experience

19

Years with Neuberger Berman

Jeffrey Hunn

Portfolio Manager

23

Years of Industry Experience

22

Years with Neuberger Berman

Blake Miller, CFA

Senior Portfolio Manager

40

Years of Industry Experience

17

Years with Neuberger Berman