Investment Strategies

>

Commodities

Commodities

Designed to provide broad, commodities exposure, participate in global growth trends and hedge against inflation using a risk-managed approach

- Diversified, futures-based portfolio of 27 commodities across six sectors

- Dynamic core allocations combined with tactical views that are actively managed on an ongoing basis

- Managed by an experienced team with a focus on risk

Hakan Kaya, PhD

Senior Portfolio Manager

David Wan

Portfolio Manager

Overview

Investment Philosophy

We believe:

- Commodities represent a unique asset class with risk/return characteristics offering strategic diversification benefits not available from other asset classes.

- Passive commodity investing is not well-defined: Exposures based on production and/or trading volume, as is the case across major commodity indices, can lead to unintended sector and risk concentrations.

- Commodities investing requires an actively managed approach, as the markets are influenced by a wide range of themes including macroeconomic and commodity-specific factors.

Investment Process

We select commodity investments through a two-step process that seeks to balance risks while providing an alternative and more diverse source of return than traditional asset classes.

Dynamic Core Strategy

- Select weights by considering:

- Risk

- Liquidity

- Roll Yield

- Seek to balance the portfolio across these factors and limit the impact of any individual commodity on total portfolio risk

Tactical Strategy

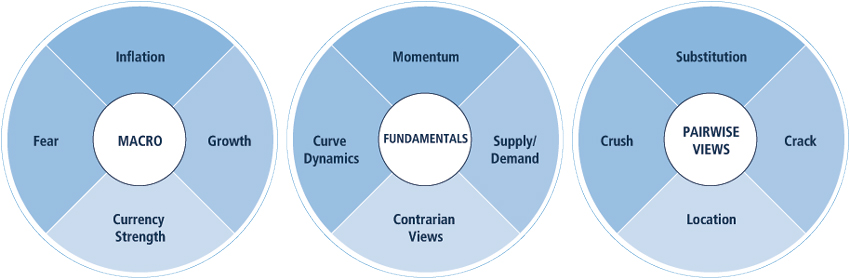

- Seek to enhance return potential by over and underweighting core exposures, following an evaluation of each commodity across three major themes:

- Macroeconomics

- Fundamentals

- Pairwise relationships

Final Portfolio

- Final portfolio constructed by combining Core and Tactical exposures

- Contract selection is a key consideration and a potential source of additional return

- Portfolio is monitored daily and rebalanced monthly

- Risk management by portfolio team and independent risk team

Tactical Tilts Used Opportunistically in an Effort to Add Alpha

We believe alpha can be generated by taking advantage of short- to medium-term market inefficiencies affecting commodities prices, ranging from macroeconomic conditions to commodity-specific fundamentals and relationships.

Macroeconomics

Positioning based on business cycle, inflation worries, risk appetite, and monetary environmentFundamentals

Fundamentals signals seek to capture the commodity futures risk premiumPairwise Views

Certain pairs of commodities have longstanding economic relationships that we seek to take advantage ofManagement

Hakan Kaya, PhD

Senior Portfolio Manager

20

Years of Industry Experience

18

Years with Neuberger Berman

David Wan

Portfolio Manager

25

Years of Industry Experience

24

Years with Neuberger Berman