Most investors today turn to international assets for extra return potential and diversification. Over the very long term the impact of the foreign-currency exposures that come with those holdings tends to be quite small, but substantial deviations from fair value can build and persist for months and years: over these periods, currency management matters. No-one is forced to take these exposures, as hedging can be implemented easily. Every institutional investor should, therefore, ask how they intend to deal with them. Until now, most investors have followed one of five traditional approaches:

- Remaining unhedged

- Hedging 100% of their exposure “passively”

- Part-hedging their exposure (50%, for example)

- Employing a “static” strategic hedge ratio determined by the historical relationship between the underlying portfolio and its foreign currency exposures (a refined version of the part-hedged solution above)

- Hedging statically with an additional “active” strategy that exploits pure alpha-generating opportunities

We believe all five approaches have substantial drawbacks. Staying unhedged involves unrewarded risk, but a full hedge can be very expensive. A “static” strategic hedge ratio has the advantage of properly integrating foreign-currency risks into the whole-portfolio construction process, but remains non-opportunistic and backward-looking. The “active” approach adds an opportunistic element, but one which is not integrated into the broader portfolio construction process. We believe the optimum approach would be dynamic and opportunistic, but also fully-integrated into the underlying portfolio: we call it the “dynamic ideal hedge ratio” and in this paper we describe the basics of the concept.

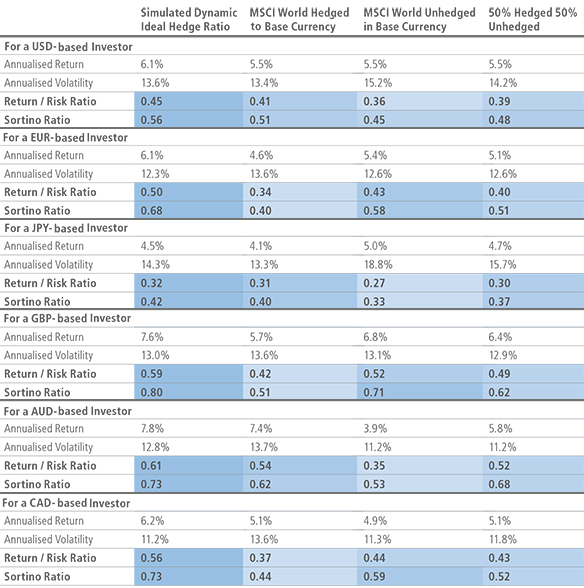

We apply our approach to the MSCI World Index, from the perspective of a USD- and a EUR-based investor, to show how its three main elements of valuation, cost of hedging and diversification between foreign currency exposures and underlying assets presented different hedging opportunities over the past 15 years. We also show the potential impact of the implied dynamic ideal hedge ratio on risk and return, before expanding those findings to a range of investors with different base currencies. Our aim is to illustrate the significant efficiency improvements our proposed approach can bring to a global portfolio and our test results for six different major base currencies all show substantial improvements in both Sharpe and Sortino ratios.

Summary Risk-Adjusted Return Results For MSCI World Index Investors Based in Six Major Currencies

Source: Bloomberg, Neuberger Berman calculations. Period under review is January 2003 to December 2015. The simulated backtested performance of the Dynamic Ideal Hedge Ratio approach has been calculated by applying the Dynamic Ideal Hedge Ratio to the underlying index on a monthly basis at month end. Figures are quoted gross of fees. The returns presented reflect hypothetical performance an investor would have obtained had it invested in the manner shown and does not represent returns that any investor actually attained. The information presented is based upon the following hypothetical assumptions. Certain of the assumptions have been made for modelling purposes and are unlikely to be realized. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. Changes in the assumptions may have a material impact on the hypothetical returns presented. Returns are gross of tax and fees and include average expected currency transactions costs over time. Past performance does not guarantee future results.