Whenever it appears that interest rates are rising, commentators warn of the reckoning that awaits risk parity investors.

That is understandable. In essence, risk parity is an approach to portfolio construction that attempts to get the most possible benefit from the diversifying characteristics of different asset classes by weighting them so that their contribution to the risk of a portfolio is roughly equal. It can define risk simply as volatility, or with some more sophisticated measure or combination of measures.

Because equities tend to be riskier than bonds (two or three times riskier, in volatility terms), the performance of a capital allocation split equally between equities and bonds will be determined mainly by equity risk—the bond characteristics will be largely drowned out. To get the benefit of the bonds, risk parity investors add to the bond allocation until its risk contribution is equal to that of the equities. To do that without compromising return expectations, however, it is necessary to leverage the resulting risk-balanced portfolio so that its overall exposure is greater than 100%, rather than simply switching some of the equity allocation for bonds. In this paper, when we build a model risk parity strategy, we leverage the portfolio to reach a volatility target of 10%—but once the risk parity portfolio is constructed, it can be leveraged to any calibration of risk or return objective.

That is why risk parity is often characterized as “leveraged bonds”: because it involves adding more bonds and then leveraging the portfolio. And if you think of risk parity as “leveraged bonds”, rising yields will seem like bad news.

We argue that this is a mischaracterization. Risk parity is not just leveraged bonds: it is a route to genuine multi-asset class diversification via the equalization of portfolio risk exposures. Moreover, most risk parity approaches do not confine themselves to equities and bonds, but add asset classes such as credit and commodities, also with equalized risk contributions. In most environments of high or rising yields, one or more of these other asset classes will perform well enough to balance negative performance of bonds. Finally, rising yields do not necessarily result in negative total returns to bonds—losses occur only when yields rise further than bond market expectations.

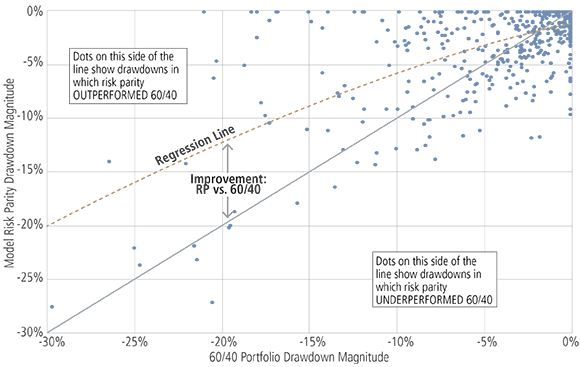

Add all of this together and we can begin to explain how risk parity portfolios can generate positive returns during high and rising-yield environments, as we will demonstrate in this article. We will show how a simple model risk parity portfolio might have fared, relative to a traditional 60/40 portfolio, through a range of scenarios, and explain some of the dynamics behind that performance.

Risk Parity Can Help Tame Drawdowns

Source: Ibbotson Associates, Neuberger Berman. Drawdowns experienced between January 1963 and June 2018.