In this paper we argue that there is a viable solution, with three elements. First, investors should look to exchange a portion of interest rate risk for higher yielding exposures to stocks, credit, and options strategies. Second, they should exploit the “free lunch” of risk-reducing diversification to the full. And third, they should further enhance their portfolios through dynamic management of their allocations to these alternative sources of income.

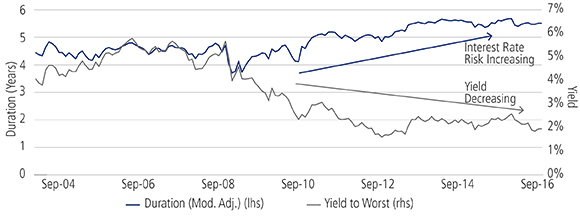

It is vital that investors reconsider what is going on in their so-called “low-risk” income portfolios. In the past these portfolios have relied on investment-grade bonds to generate stable income with low price volatility. But today, investment-grade bond yields are simply too low to allow most individual savers to maintain their incomes and lifestyles. Those low yields also increase investors’ exposure to the risk of substantial capital loss: the higher bond prices are, the further they can fall, and the more sensitive they become to changes in interest rates (figure 1).

Figure 1: Double Whammy: As Bond Yields Collapse, Interest Rate Exposure Increases

Duration and Yield of the Barclays US Aggregate Bond Index

Source: Barclays.

The good news is that we believe there is a viable solution for income investors, with three elements:

- Seeking higher yields from alternative sources of income

- Exploiting the risk-reducing power of diversification to the full

- Managing asset allocation dynamically

In this paper we will look beyond investment-grade bonds to find income available at higher yields from sectors of the credit and equity markets, and from sophisticated investment techniques such as equity-index options strategies.

“This is not simply adding risk to portfolios, but rather exchanging one type of risk for a range of others.”

“This is not simply adding risk to portfolios, but rather exchanging one type of risk for a range of others”-->

These alternative sources of income are undeniably less secure than the income from investment-grade bonds—and we would advocate replacing only a portion of the investment-grade allocation in an income portfolio. However, it is important to understand that this is not simply adding risk to portfolios, but rather exchanging one type of risk for a range of others: we will show that combining alternative sources of income diversifies away a lot of the extra risk associated with holding them individually. We will also show how investors can use sophisticated investment strategies and instruments to enhance that portfolio diversification and further reduce total-portfolio risk.

Higher Yields from Alternative Sources of Income

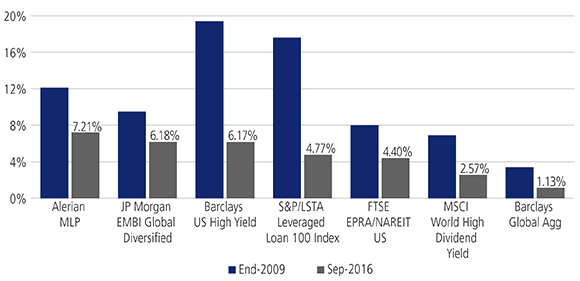

Over recent years yields from alternative sources of income have come down just as surely as they have from investment-grade bonds. As figure 2 shows, however, yields from investments such as high yield bonds, bank loans and high-dividend equities remain compelling on a relative basis.

Figure 2: Yields From Alternative Sources of Income May Be Lower Than in 2009, But They Remain Compelling Relative to Investment-grade Bonds

Yields, End-2009 and End-September 2016

Source: Bloomberg, FactSet, Alerian.

Let’s start with high yield bonds. Over the past 15 years, monthly returns from U.S. high yield have exhibited 10% volatility, versus 8% from the U.S. 10-year Treasury. But at the end of September 2016, the high-yield universe offered 504 basis points more yield than investment-grade bonds. As a result, the ratio of total return-to-volatility has been almost identical for both asset classes.

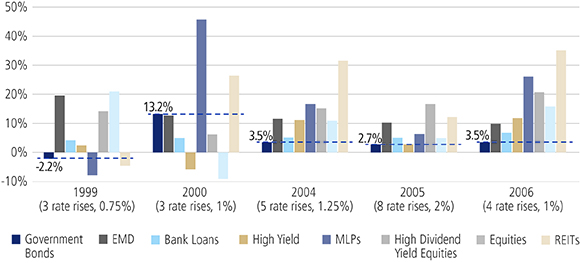

Just as important in today’s environment is the fact that moving from investment grade to high yield reduces exposure to interest-rate risk. Figure 3 shows that, while interest rates were going up, returns from high yield bonds, as well as the other alternative sources of income we will discuss here, have tended to be higher than those of investment-grade bonds. This makes sense: tightening monetary policy is usually a response to robust economic activity, which allows companies to generate the cash to service their debt. That benefits investment-grade corporations, too, but the wider high-yield credit spread can absorb a larger part of the rise in underlying Treasury yields.

Figure 3: Outside the Dotcom Crash, Alternative Sources of Income Have Outperformed Government Bonds During Recent Rising-Rate Cycles

Returns During Calendar Years that Include More Than One Rise In The U.S. Federal Funds Rate

Source: Bloomberg, FactSet, Alerian

Investors who expand their high-yield exposure to include bank loans can benefit from cash flows that actually rise with interest rates: loan rates are usually re-set every 90 days at a spread over 3-month Libor, as long as Libor itself is over 100 basis points. As Libor recovers from its post-financial crisis lows, loan income will generally rise, and potentially the capital value, too.

<!--“Income investors should look to diversify regionally, too”-->

“Income investors should look to diversify regionally, too.”

Income investors should look to diversify regionally, too. Emerging markets debt still offers compelling yield relative to developed market bonds, even after adjusting for slightly lower credit quality. Again, emerging markets assets have tended to perform well while global interest rates have been going up—although some benefit can be lost when rising rates coincide with a stronger U.S. dollar, in which many emerging market sovereign and corporate liabilities are denominated.

As we have observed, rising rates are often a sign of a growing economy, which tends to be positive for high yield and emerging markets debt. The same is true for equity markets. Strip out the year 2000, when three rate hikes coincided with the dotcom crash, and the S&P 500 Index has posted positive returns in each of the last eight calendar years in which U.S. rates went up.

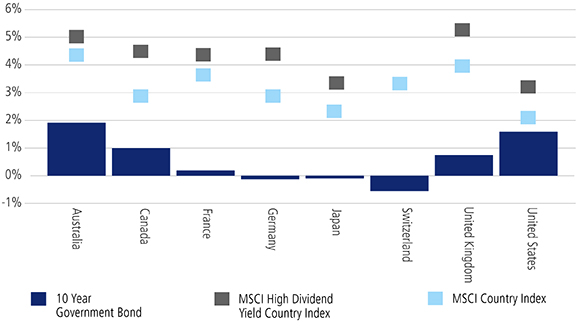

Equities are considerably more volatile than bonds, and high dividend yield can be a sign of low valuation—often a powerful source of long-term returns, but sometimes a reflection of problems at the company in question. For income investors, therefore, we would advocate a strategy that seeks the best combination of high yield and dividend sustainability. MSCI’s High Dividend Yield indices implement this kind of approach and, as figure 4 shows, such an approach still delivers substantial excess yield compared to broad equity or bond markets.

We also encourage investors to consider specialist equity-market sectors exposed to underlying assets that generate high levels of income. Examples are Real Estate Investment Trusts (REITs, or listed companies that own income-generating property) and Master Limited Partnerships (MLPs, which operate businesses in the income-generating corners of the natural-resources sector).

Figure 4: Equity Dividend Yields Offer High Spreads Against Most Core Government Bonds

Government Bond Yields vs. Equity Index Dividend Yields

Source: FactSet. Data as of September 30, 2016. There is no MSCI High Dividend Yield Index for Switzerland.

Finally, investors can look beyond simple asset classes and sectors and deploy sophisticated income-generating strategies. Selling (or “writing”) options is a good example. Because there tend to be more buyers than sellers in option markets, especially for put options used to hedge downside risk, the upfront premiums that sellers collect tend to be larger than the volatility of the underlying assets suggests they ought to be.

<!--“Investors can look beyond asset classes and deploy sophisticated strategies such as writing options”-->

“Investors can look beyond asset classes and deploy sophisticated strategies such as writing options.”

Several different strategies can be pursued. Covered call writing involves selling call options on shares already owned: the buyer pays up for the right to buy underlying stock at a specified price, while the seller accepts a limit on capital appreciation in return for enhanced portfolio income. Collateralized put writing, on the other hand, generates premium income from allowing the put buyer to sell a stock or index back to the put seller at a specified price.

The Risk-Reducing Power of Diversification

Keep in mind that investors who replace some investment-grade bond exposure with allocations to alternative sources of income are not simply adding risk to their portfolios. Rather, they are exchanging one type of risk (interest rate sensitivity, or “duration”) for a range of other risks (credit, equity, complexity and so on).

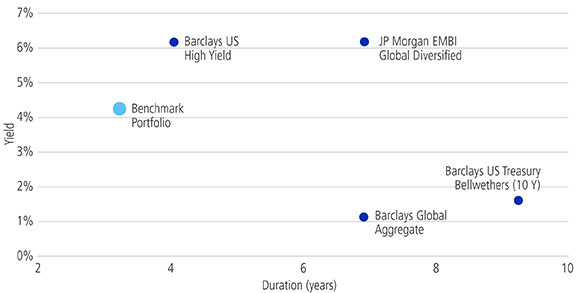

Take a look at Figure 5. The yield of a naïve benchmark portfolio constructed from these alternative income assets and a component of government bonds (based on the average allocations of commercial multi-asset income funds) is considerably higher than the yield of an investment-grade portfolio, but its interest-rate sensitivity is considerably lower. In the current low-yield environment, that helps to solve both of our key problems: lack of income and potential downside risk to capital.

Figure 5: A Diversified Portfolio of Alternative Sources of Income Currently Offers a Compelling Duration-For-Yield Trade-Off

Yield and Duration

Portfolio Benchmark

| Index | Weight (%) |

|---|---|

| MSCI USA High Dividend Yield | 23 |

| MSCI World ex-USA High Dividend Yield | 12 |

| Alerian MLP | 5 |

| FTSE EPRA/NAREIT US | 5 |

| Barclays US High Yield | 15 |

| S&P/LSTA US Leveraged Loan 100 | 15 |

| JPMorgan EMBI Global Diversified | 15 |

| Barclays US Long Government Credit | 10 |

Source: Bloomberg, FactSet, Alerian. Data as of September 30, 2016.

The price is higher volatility. But recall that creating this portfolio entails moving from one major exposure to several—economic growth, energy, emerging economies, real-asset capital appreciation—which not only diversify against investment-grade bonds, but also against one another.

“A simple alternative income portfolio can provide a higher yield than investment-grade bonds, with lower interest rate sensitivity, helping to solve two key problems: lack of income and potential downside risk to capital.”

“A simple alternative income portfolio can provide a higher yield than investment-grade bonds, with lower interest rate sensitivity, helping to solve two key problems—lack of income and potential downside risk to capital”-->

As a result our naïve benchmark portfolio would have experienced slightly higher volatility than investment-grade bonds, historically, but a much better return-to-volatility ratio. In short, history strongly suggests it is possible to raise the yield of an income portfolio without taking on substantially higher volatility.

Investors able to access additional diversifying strategies, including alternative risk premia, can improve the risk profile of an income-oriented portfolio even further.

Alternative risk premia are exposures to risk “factors” such value, momentum and carry, which, if captured in isolation, have been shown to be both compensated and highly diversifying against traditional stock, bond and inflation-sensitive investments.1

In order to capture the factors and include them in a multi-asset income portfolio, an asset manager generally needs to use alternative investment techniques such as shorting (to isolate the factors using long/short strategies) and derivatives (to make strategies capital-efficient enough to benefit from their strong diversifying characteristics without reducing overall portfolio income). Where suitable, investors able to adopt these sophisticated approaches can make alternative risk premia a powerful tool for managing the volatility of higher-yielding income portfolios.

Managing Asset Allocation Dynamically

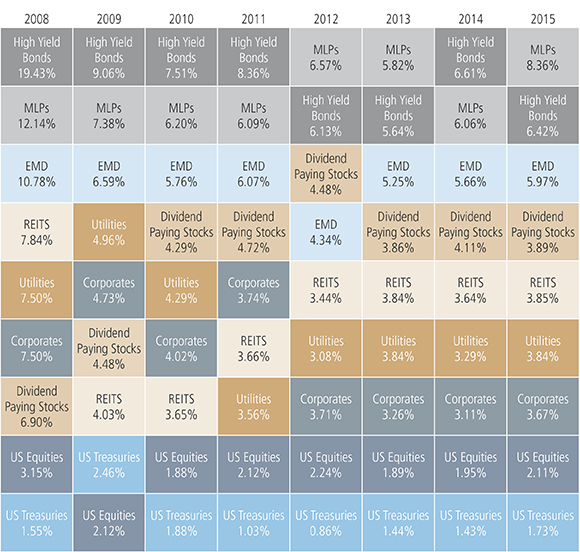

Diversification is not only beneficial in itself. When asset classes perform differently over time it creates opportunities for tactical and dynamic asset allocation. Figure 6 shows how the relative yields available on different income asset classes are constantly changing rank—and note that these year-end yields do not capture the windows of opportunity that open briefly during bouts of market volatility.

For these reasons, we believe yields from a multi-asset income portfolio can be maintained and returns significantly enhanced by opportunistic asset allocation informed by top-down views on business and credit cycles, as well as bottom-up security selection within one’s chosen asset classes.

Figure 6: Changing Relative Yields Can Reward a Dynamic, Opportunistic Approach to Asset Allocation

Yield to Worst for Key Asset Classes

Source: Bloomberg, Morningstar. Data is year-end. High Yield – Barclays US Corporate High Yield Index. MLPs – Alerian MLP Index. Emerging Markets Debt – Barclays EM USD Aggregate Index. US REITs – FTSE NAREIT All Equity REITs Index. Utilities – Barclays Investment Grade Utility Index. US IG Credit – Barclays US Corporate Investment Grade Index. Dividend Paying Stocks – MSCI World High Dividend Index. US Equities – S&P 500. US Treasuries – Barclays US Treasury Index.

Conclusion

Today, yields from the investment-grade bonds at the heart of traditional income portfolios are simply too low to allow most individual savers to maintain their cash flows and lifestyles. Low yields also increase the risk of substantial capital loss: the higher bond prices are, the further they can fall, and the more sensitive they become to changes in interest rates.

In this environment replacing a portion of a traditional investment-grade bonds portfolio with some alternative sources of income begins to make sense for some investors. While this can add to portfolio volatility it is important to remember that the process does not simply add risk, but rather exchanges one type of risk for a range of others. Because these other risks are mutually diversifying, much of the additional volatility of the individual exposures can be diversified away and the overall portfolio’s yield-to-volatility ratio can be substantially improved.

In this paper we have briefly outlined some of the alternative income-generating assets available to investors. Everyone will bring their own parameters, preferences and tolerances to the challenge, and many will seek out well-designed, dynamically managed multi-asset income solutions rather than attempt to pull these exposures together themselves.

We do believe that every investor needs to consider how to adapt to today’s low-rate fixed income environment. Investment-grade bonds will still meet some investors’ specific requirements. But for many others, adding an alternative approach to income-generation will be a much better option—and, as we have seen, there are alternatives available.