By converting traditional equity investment return potential (i.e., capital appreciation and dividends) into tangible upfront cash flows via the consistent collection of option premiums and interest income, equity index put writing strategies reshape the return distribution of the underlying equity index. This augmented return distribution can play a meaningful role in investor portfolios by diversifying traditional equity index allocations and supplementing the cash generation of yield-oriented investment allocations.

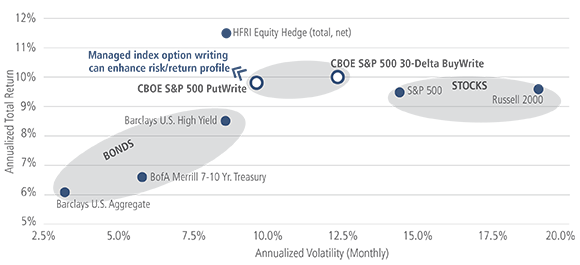

As shown below, put-writing strategies—as represented by the Chicago Board Of Exchange’s S&P 500 PutWrite Index (the “PUT Index”)— since 1986 have delivered a total return consistent with most equity indexes while experiencing a notably lower level of volatility, resulting in a more risk-efficient equity index exposure over the period.

Potential to Enhance Portfolio Risk Efficiency

Index Annual Return vs. Risk (January 1990 – March 2017)

Source: Bloomberg LP, CBOE. Though the PUT Index was introduced in 2007, the CBOE provides historical back-tested data on the PUT Index starting from June 30, 1986.

Implementing an appropriate option writing strategy for an institutional portfolio requires an in-depth analysis of asset owners’ investment goals and existing portfolio allocations and an evaluation of how an option writing strategy (funded or overlay) can work toward improving the likelihood of investment success. Asset owners should seek to partner with experienced asset managers that have long and successful track records in the options space. Managers should emphasize transparency, consistency and cost-effectiveness of strategies while helping institutional investors address a variety of allocation needs and risk/return profiles.