US Real Estate Securities

A focused, high-conviction strategy that seeks attractive current income and long-term capital growth by investing in a diversified portfolio of real estate securities

- Disciplined in-depth research process that balances real estate and securities analysis to determine the optimal portfolio mix among property types

- Tactically rotates among property sectors/geographic regions based on economic and regional fundamentals

- Experienced co-portfolio managers have worked together since 2003, managing through numerous real estate and economic cycles

Key Risks

Market Risk: The risk of a change in the value of a position as a result of underlying market factors, including among other things, the overall performance of companies and the market perception of the global economy.

Liquidity Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Real Estate Risk: Portfolios that invest primarily in either real estate or real estate related loans are subject to greater potential risks and volatility than a more diversified portfolio, there are particular risks associated with the direct ownership of real estate by REITs.

Counterparty Risk: The risk that the portfolio may be unable to sell an investment readily at its fair market value.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Currency Risk: Investments in a currency other than the base currency of the portfolio are exposed to currency risk. Fluctuations in exchange rates may affect the return on investment. If the currency of the portfolio is different from your local currency, then you should be aware that due to exchange rate fluctuations the performance may increase or decrease if converted into your local currency.

Overview

Investment Philosophy

Seeks total return through investment in real estate securities, emphasizing both income and capital appreciation

- Believe companies with value-added management, operating in high-barrier-to-entry markets, economies of scale and balance sheet strength offer the most attractive upside potential

- Seek to identify companies with access to capital and staggered debt maturities

- Rotate property sectors/geographic regions based on economic / regional fundamentals

- Buy/Sell decisions based upon proprietary fundamental research with an emphasis on team-built valuation model

Investment Process Overview

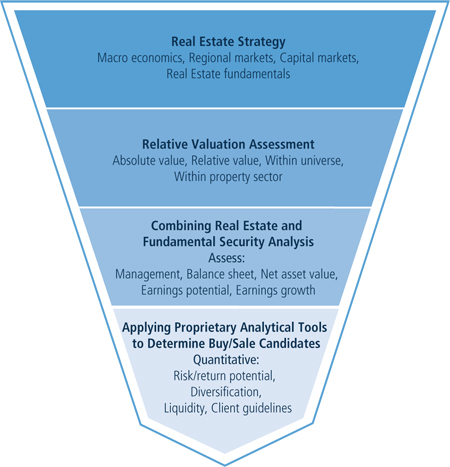

Focus on experience-based, in-depth credit and industry analyses, disciplined portfolio construction and ongoing portfolio surveillance.

Equity Real Estate Securities Universe

~200 companiesProperty Sectors Available in the Public Market

Residential, Office, Retail, Health Care, Industrial, Infrastructure, Lodging, Self Storage, Data Centers, TimberMarket Cap Screen

minimum $300mnApproved List

~150 securitiesFinal Portfolio

- 35 - 45 holdings

- Active management

- Under 75% turnover

- Diversified geographically and by property type

- Maximum 5 -10% cash position