|

Neuberger Berman 5G Connectivity Fund |

|

|

|

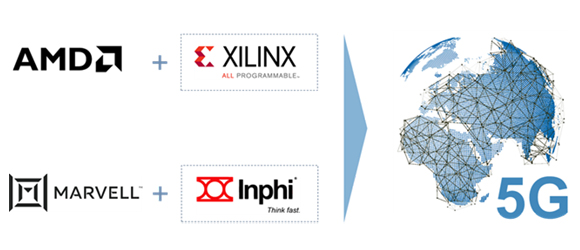

| 5G Driving Strategic Semiconductor M&AS | |

Source: Site Selection magazine, Neuberger Berman |

|

|

5G is presenting new growth opportunities for semiconductor companies to expand beyond their core addressable markets as semiconductor dollar contents increase. In October, two prominent semiconductor M&A deals were announced with Advanced Micro Devices acquiring Xilinx for $35 billion and Marvell acquiring Inphi for $10 billion. Both M&A deals are strategic and will make the acquirers considerably larger players to lead in the rapidly growing 5G & data infrastructure markets. |

|

|

For AMD, incorporating Xilinx’s market dominant “adaptive computing” technologies, mainly in FPGA (field programmable gate arrays) chips, would enable the combined company to expand from PC & data center to new market including edge computing, 5G networks and automotive. For Marvell, Inphi’s leading-edge high-speed data interconnect semiconductor technology would better position the combined company to enable end-to-end technology solutions for hyperscale data centers and 5G wireless infrastructure. |

|

|

Driven by rapid growth in 5G network & connected devices, we expect more exciting developments in the semiconductor industry with continued technology enhancements and potential M&A opportunities. |

|

| Did You Know? | |

|

Economic Recovery At Risk Without a Faster 5G Rollout |

|

Source: Assembly Research, Neuberger Berman |

|

|

A new report by the Centre for Policy Studies argues that the UK’s recovery from the COVID-19 pandemic is at risk without a faster 5G rollout and around 11 million of households and businesses will miss out on digital connectivity and growth opportunities. The report estimates the difference between the UK being a leader and a laggard in 5G adoption could be as much as £173 billion in incremental GDP over the coming decade. Given 5G’s rising impact on the economy, 5G is no longer just a nice-to-have and many countries around the world are strategically investing in 5G to drive faster economic recovery in the post-pandemic era. |

|

|

5G News |

|

|

|

|

|

|

|

|

|

|

|

|

|

Featured Stock Story |

|

|

Inphi (Nasdaq: IPHI) |

|

Source: Inphi, Neuberger Berman |

|

|

Inphi is a leading fabless semiconductor company that enables higher network bandwidth capacity in data centers and 5G networks. With exponential growth in data traffic, networking technologies in data centers are migrating from 100G to 400G/800G which requires specialized digital signal processors (DSPs). With over 80% market share in high-performance DSPs for 400G/800G, Inphi is well-positioned to benefit from the multi-year network upgrade cycle. |

|

|

The company estimates the 400G DSP & interconnect market to grow at 57% CAGR between 2018-2022 to reach over US$4 billion, driven by accelerating growth in cloud data centers and 5G networks. Today, the company’s semiconductor solutions are enabling key players in data center & networking including Microsoft, Cisco, Amazon, Google and Facebook. We believe the acquisition by Marvell will provide the new combined company a more comprehensive & competitive product portfolio to enable the next generation 5G network architecture. |

|

|

|

|

We would like to hear from you any questions you may have on the 5G investment opportunities. |

|

| >> Submit your question here | |

|

We look forward to sharing more. |

Article

5G Driving Strategic Semiconductor M&As

October 27, 2020

For Available Investments

and Market Insights