More than $17 billion in institutional flows were directed to passive international equity strategies globally in 2017, according to eVestment. This capital came at the expense of active managers, who saw $29 billion in outflows during the year. These numbers perhaps are not totally surprising given recent industrywide trends toward passive investing. Passive investment products across the equity spectrum have attracted investors for reasons ranging from perceived lower costs to a desire to maintain beta exposure in certain asset classes in order to allocate active risk to others.

As we demonstrate in this paper, however, investors that opt for passive exposure to non-U.S. equity markets are not only forgoing the potential to add above-benchmark returns over a full market cycle, they may also be giving up the risk management that historically has buffered investors from the full impact of down markets—a feature that may become particularly impactful to the total returns of international equity portfolios as markets become more volatile and two-way.

Executive Summary

- Investors that opt for passive exposure to non-U.S. equities may be giving up both the potential for above-benchmark returns and the risk management that can help mitigate losses incurred in down markets.

- Active non-U.S. equity strategies have consistently outperformed the MSCI EAFE Index over a variety of time periods since the global financial crisis. A common thread among the outperforming strategies is effective risk management, as evidenced by their attractive downside-capture statistics.

- There are inherent limitations to passive investment portfolios attributable to the method by which equity indexes—and thus the passive strategies that track them—are constructed. These may include static coverage of non-U.S. equity markets and capitalization-weighted exposure to stocks regardless of their profitability or valuation.

- Profitable companies historically have delivered better returns than those that lose money, highlighting the value of an active manager that can look across an expansive investable universe of more than 11 sectors, 21 countries and 3,700 stocks—both in and outside of the benchmark—to seek to identify exploitable mismatches between a stock’s valuation and its potential profitability.

- Increased market volatility and bidirectional price movements may usher in a period during which disciplined stock selection and limited downside capture become even more important to the total returns of international equity portfolios.

Relative Performance Favors an Active Approach

Despite the aforementioned fund flow data that would seem to suggest the contrary, active international equity managers have outperformed the benchmark handily over the past three years; the return of the MSCI EAFE Index—the most widely used benchmark for international equity strategies—placed in the 77th percentile compared to the broad eVestment EAFE Large Cap Core universe over this period. In fact, our analysis of active strategies in the eVestment EAFE Large Cap and EAFE All Cap universes benchmarked against the MSCI EAFE Index found that a significant majority outperformed the benchmark over all time periods going back over the last decade (2008–17), a time span that includes a few full market cycles.

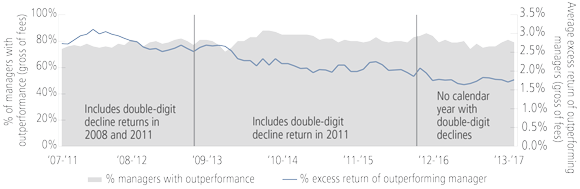

As Figure 1 illustrates, a consistent 70–80% of active managers included in the aforementioned analysis have outperformed the index, on a gross of fee basis, over rolling five-year periods ended between 2011 and 2017. While the magnitude of average outperformance has fallen gradually from around 300 bps over the five-year periods ended earlier this decade—which captures such volatile times as the 2008 financial crisis and the 2011 Euro crisis—to its current 175 bps, it appears to have bottomed. We think the relative success of active management in non-U.S. equity markets could rebound in the near term as higher market volatility and lower stock return correlations provide international stock pickers increased opportunities to generate alpha.

Figure 1. Active Managers Have Consistently Outperformed the Benchmark Post-Crisis

Rolling Five-Year Relative Performance of Active EAFE Managers versus MSCI EAFE Index, 2007–17

Source: eVestment, data as of December 31, 2017.

Our analysis of the historical performance data showed that active strategies produced a downside capture ratio of less than 100—meaning that active managers typically lost less than their benchmark in down markets—in 72% of the five-year rolling periods during the measurement period. More revealingly, the magnitude of average active outperformance was greater in those five-year periods that captured both incidents of double-digit annual declines in the benchmark (2008 and 2011), pointing to a key differentiator that we believe helps effective active managers outperform their benchmarks in challenging markets: risk management. Of those strategies that delivered excess returns in our analysis, 81% of the time they did so while achieving a sub-100 downside capture ratio. These statistics not only suggests a relationship between the number and severity of down markets and the ability of active managers to deliver alpha, but also the vital role risk management plays in generating outperformance.