The experience of a sharp market drop right before or early into retirement can have a significant impact on the outcomes of participants who simply don’t have enough time to recoup the losses.

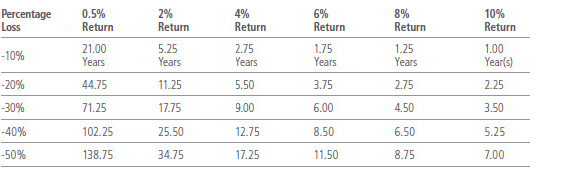

The table below provides a look at hypothetical losses and the time it would take to recoup them based on different rates of return.

Years to Recovery from Investment Losses

Source: FactSet. This hypothetical illustration shows how many years it would take to recover from losses of different given magnitudes at varying rates of returns. The illustration is based on mathematical principles and assumes monthly compounding. It is not meant as a forecast of future events or as a statement that prior markets may be duplicated. Recovery periods are rounded to the nearest quarter of a year. The hypothetical returns do not depict that of any Neuberger Berman product or strategy.

In the context of target date funds (TDFs), views on how to deal with this issue are essentially divided into two camps. On one side are the “to” advocates, who argue that as TDFs approach their named end date (the point where they have the shortest timeframes to retirement) they should have the lowest possible exposure to equities and other assets whose historical volatility may reemerge at unfortunate times. On the other side are the “through” advocates, who argue that equity exposure should still be moderate at retirement to provide growth potential and to keep up with inflation. This camp may acknowledge the risk of a drawdown, but generally consider longevity—or the risk of participants outliving their money due to longer lifespans—to be a greater risk to participants today.

Over the course of the current eight-year bull market, we note that the pendulum has generally swung to the “throughs.” However, we suspect that many plan participants and sponsors may have fading memories of the extreme losses of 2008 and previous severe declines—something that could be potentially dangerous at a time when equity valuations are commonly viewed as elevated and global economic relationships are in flux.

Middle Road: Seek Appreciation with Lower Risk

Rather than taking an extreme position, we believe that while it’s important to limit exposure to market risk, it’s also vital to seek some growth even as TDFs approach their end dates.

One way to deal with the equity risk dilemma is to introduce approaches that allow participants to continue to capture investment returns offered by equities but dampen risk exposure. Certain options strategies may fit this description and can be added to TDFs to enhance the risk-managed approach. Today, most defined contribution plans offer an allocation to large-cap equities, either actively managed or indexed. A plan sponsor might consider replacing some of that exposure with an allocation to a fully collateralized options strategy.

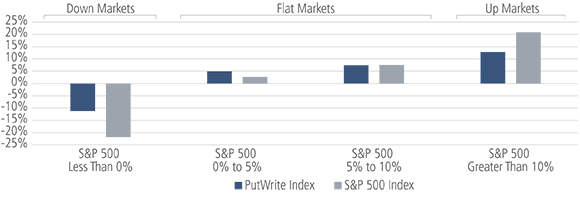

For example, the CBOE S&P 500 PutWrite Index tracks a hypothetical portfolio that every month sells put options on the S&P 500 Index, fully collateralized by short-term Treasuries (“PutWrite”). The index repeats the process each month, allowing it to collect option premiums 12 times per year.

CBOE S&P 500 PutWrite Index: Potential for Equity-Like Returns with Lower Volatility

Rolling 12-month returns (June 2007 – March 2017)

Source: CBOE and Bloomberg. Index data sourced from Bloomberg LP and is gross of fees unless stated otherwise. Selected time period reflects longest common history of indexes. Analysis period is limited by the CBOE S&P 500 PutWrite (“PUT”) Index, which incepted in June 2007. Unless otherwise indicated, returns shown reflect reinvestment of dividends and distributions. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

Overall, the net result has been to achieve exposure to market gains while suffering less steep declines, as shown above. Additionally, active strategies are available that take the index processes and seek to enhance them to improve the results.

Concluding Thoughts

Regardless of whether your TDF uses a “to” or “through” glide path, participants approaching retirement face the most risk from a market shock. Introducing options strategies designed to offer equity exposure while dampening risk is one approach to consider adding to your TDF asset allocation. They may provide better risk mitigation against future market shocks while helping participants get closer to achieving their retirement goals.