After years of trial and error, plan sponsors are generally in a good place in providing plan features. Auto-enrollment, streamlined record systems, education programs and broadly diversified offerings are typically in place to make plans welcoming and functional. However, as sponsors know, participation isn’t as robust as it could be. The median retirement savings for U.S. employees age 56 – 61 is just $17,000,1 while the overall retirement income deficit—the gap between savings and retirement needs—has grown, from $6.6 trillion in 2009 to $7.7 trillion in 2015.2

If sponsors are checking all the right boxes in terms of plan design, then what’s contributing to the shortfall in participation? In our view, a key issue is financial worries, which are affecting participants’ ability to set aside funds in retirement plans.

According to the latest PwC Employee Financial Wellness Survey,3 nearly half of employees are stressed about their financial situation. Millennials and Generation Xers commonly cited emergency savings as a worry, while Baby Boomers most often voiced fear that they would be unable to retire. Indeed, many respondents anticipated withdrawing from retirement accounts to pay non-retirement expenses.

Dangerous Trend: Tapping Retirement Accounts for Other Needs

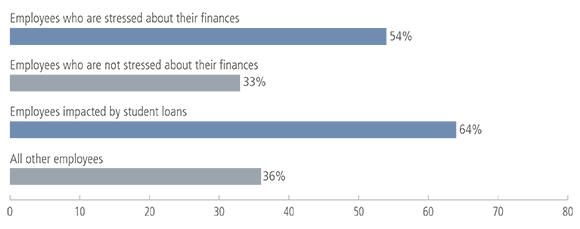

Employees who think it’s likely they’ll need to use money held in retirement plans for expenses other than retirement:

Source: Employee Financial Wellness Survey, PwC, 2018.

To some degree, the situation is a function of broader trends such as slow wage growth and higher education and health care costs. But employers have come to understand the negative impacts that financial stresses can have, not only on employees but on a company’s bottom line by way of absenteeism, higher health costs and lower productivity. As a result, many are taking a step forward to help their workers via “financial wellness” programs.

Programs and Prognosis

The outlines of such programs vary considerably. They may involve “lunch-and-learn” seminars, self-guided learning and/or individual counseling on balancing budgets, paying off debt and other topics. In some cases, companies provide financial incentives for engagement, such as bonuses for attending financial literacy programs or matching funds for employees to reduce student loan balances. There are even apps to provide employees with reminders to stay on budget and keep saving for emergencies, retirement and other needs.

The results so far have been encouraging. According to the PwC survey, 35% of employees said their employer offered services to assist them with personal finances, of which nearly two-thirds said they had used the services. Forty-one percent say their employer’s financial wellness program has helped them get their spending under control, while 39% say it has helped them prepare for retirement and 31% say it has helped them pay off debt.

In our view, the ground covered by such programs can be as extensive as the financial challenges employees may face—not just the basics, but also life events such as purchasing a home, getting married, raising a family, paying for children’s college or saving for retirement. Fostering the confidence to deal with these issues will hopefully lead to a better financial picture for a happier, more productive workforce. It may even boost retirement contributions in the process.