In a rising interest rate environment, the case for senior floating rate loans should be revisited. Indeed, we believe there are a number of compelling reasons for investors of all types—including insurance companies seeking a safe source of yield potential—to consider a strategic allocation to the asset class:

- Attractive yield potential. The yield of the senior loans asset class was among the highest of all fixed income asset classes (as of December 2016, S&P Global Market Intelligence).1

- Protection against duration risk. Senior loans have very low duration, and their coupons generally adjust regularly based on the London Interbank Offered Rate (LIBOR).

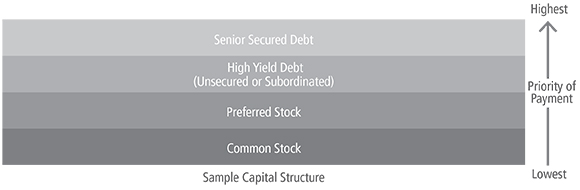

- Mitigation against credit risk. Senior loans typically are secured, and their senior positioning in the capital structure offers protection relative to high yield bonds.

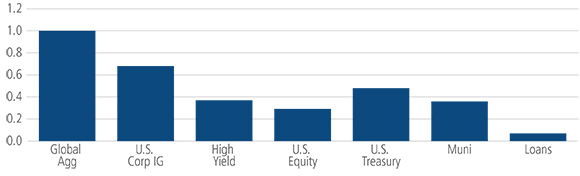

- Low correlation to other asset classes. Historically, senior loans have shown the potential to outperform the broader fixed income market in flat and rising rate environments. Loans typically have a low correlation to other fixed income asset classes, and we believe they can provide diversification benefits in investor portfolios.

Senior floating rate loans provide a unique combination of relatively high income potential and low duration thanks to their floating rate coupon. In addition, the senior secured nature of the loans mitigates credit risk, as their seniority creates lower expected losses compared to other non-investment grade assets.

Their lower correlation to other major asset classes also provides diversification and reduces a portfolio’s overall risk when compared to instruments with higher sensitivity to interest rates. And senior floating rate loans have historically provided investors with lower volatility compared to other risky and long-duration assets as well.

Why Should Insurers Consider Senior Loans?

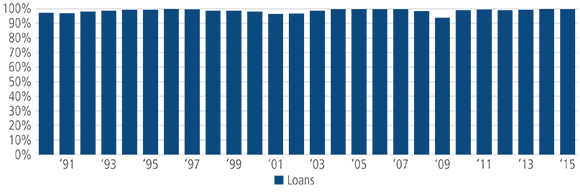

Insurance portfolios have been investing in floating rate loans in many forms for years. The loan market remains generally strong and resilient post-crisis, having behaved quite well in the wake of 2008–09 (S&P LCD Leverage Loan Index). While most would agree that the U.S. credit market is in the later stages of an atypical credit cycle, we believe the cycle is likely to extend as the below-investment grade market broadly has been able to term itself out into the 2020s, with less than $50 billion in senior floating rate loans coming due through 2018. Our default estimate through 2017 is a well-behaved 2.5–3%, and given the maturity profile of the broader below investment grade market, we simply don’t see a liquidity crunch on the horizon.

We are modestly upbeat about the prospects for the U.S. economy, and the broad profile of credit spreads suggests that other share this sentiment. Floating rate loans have continued to tighten through a wave of refinancing, but three-month LIBOR forward expectations are roughly 75 basis points higher versus current levels, and we expect loan investors to begin benefitting from higher rates accordingly.

For insurance companies, there are several compelling reasons to consider senior floating rate loans:

- Later-stage credit cycle defense. Senior secured position in the capital structure has implications for default and recovery levels.

- Relative value. The risk-reward trade-off appears biased toward loans versus other credit markets. Loans tend to be well-behaved in terms of price stability, and we think improving yields may offer potential upside going forward.

- Technical support. CLO risk-retention capital has been raised across the industry—including by Neuberger Berman; as such, capital is sitting on the sidelines looking for an opportunity to step in with new CLO issuance. Our view is that this form of technical support is unique to the bank loans asset class.

- Potential changes to capital charges for the insurance industry. The National Association of Insurance Commissioners is in the process of addressing capital charges relative to assigned ratings for securities.

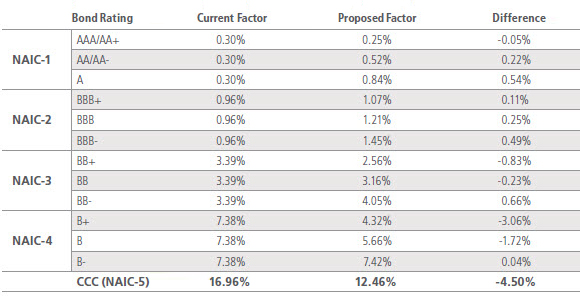

Figure 1: Changes to NAIC Capital Standards May Be Coming

<!--Given their floating rate coupon, loans have historically offered a low correlation to the Global Aggregate, which is a longer duration asset class, as the chart below highlights.

-->

Source: American Academy of Actuaries.

The current proposal impacts life companies, but these changes potentially could impact the entire U.S. insurance industry as well. Notably, the proposed charges are higher for BB- and B- issues and lower for other ratings cohorts within NAIC 3 and 4. These proposed changes likely will impact how insurance companies take on exposure to below investment grade risk.

Given all of these factors, we would argue that floating rate loans can play an important role for insurance portfolios. With relatively tight spreads evident in credit markets and the specter of higher interest rates looming, we believe senior loans can be very effective in supporting insurance capital profiles both in terms of regulatory impact and through their relative price stability.

Senior Floating Rate Loans: A Primer

Generally arranged by banks on behalf of businesses and then sold to institutional investors, these loans typically back recapitalizations, acquisitions, refinancings, leveraged buyouts, capital expenditures and other general corporate purposes. They are typically the most senior debt position within the borrowing firm’s capital structure, which means they would be the first to be paid back in the event of default. Many of these borrowers are household names (e.g., United Airlines, Goodyear Tire and Hilton Hotels), and the market contains more than 1,000 issuers and over 30 different sectors, making up about $900 billion in par value.

There is an active secondary market for the loans, with over $2 billion of average trading volume per day, and a wide range of participation from institutional investors. Collateralized loan obligations (CLOs) are the largest buyers of loans, although investor diversity has increased over the past 10 years. Retail mutual funds, for example, now hold around 20% of all loans outstanding.

As noted in the introduction, there are a number of reasons for investors to consider senior loans in the current environment.

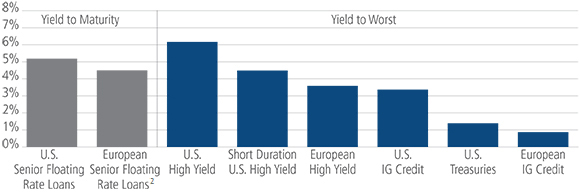

Attractive yield Potential. The yields of the floating rate loans asset class are typically among the highest of all fixed income asset classes. As of December 2016, U.S. loans, for example, have yielded 5.4% according to Bloomberg (based on the loan index) just shy of U.S. high yield and significantly higher than government bonds and investment grade corporates. Given the low yield environment around the globe, a higher income-producing investment could be attractive to a diverse set of investors.

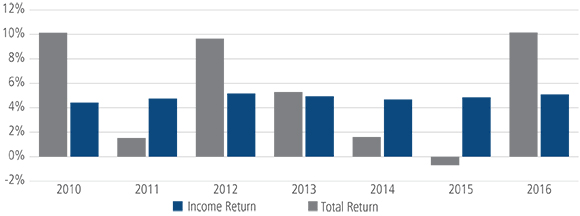

The income component of the senior loan total return has historically provided stability to overall returns. Indeed, the significant regular distributions help to dampen any potential mark-to-market volatility on the underlying loan prices.

Figure 2: Asset Class Yield Comparison

Source: S&P Capital IQ LCD & Bank of America Merrill Lynch.

2Excluding currency fluctuations.

Figure 3: Total Return Composition

Source: S&P Capital IQ. As of December 31, 2016. Past performance is not indicative of future returns.

Protection against a rising rate environment. The coupons on floating rate loans generally reset every 30 to 90 days, and the reset is based on the prevailing LIBOR rate at that time. Given that the coupons are reset in very short intervals, based on one- or three-month LIBOR, this means that floating rate loans have near zero duration. And, as an added benefit, as LIBOR rises, so does the coupon paid on the underlying loan, increasing the income to investors.

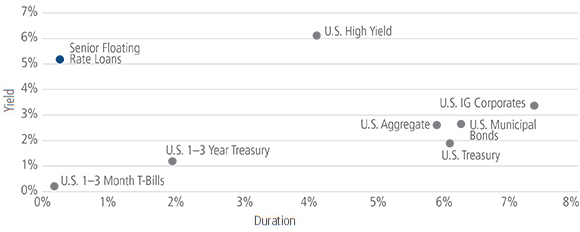

As you can see below, when you combine the historical yields on loans with the low duration, the result is the highest ratio of yield per unit of duration versus other major fixed income asset classes.

Figure 4: Yield Versus Duration

Source: FactSet, Barclays POINT. Past performance is not necessarily indicative of future results. As with any investment, there is the possibility of profit as well as the risk of loss.

In addition, when we look at the last five periods of rising rates since 1999, the performance of loans versus bonds highlights their relative stability and outperformance compared to other fixed income asset classes. The relative outperformance is particularly acute when compared to government bonds.

Figure 5: Loan Performance in Rising Rate Environment

Source: J.P.Morgan.

Protection against credit risk. The senior secured positioning that loans hold on the capital structure can help reduce credit risk to investors, which other investments typically do not provide. Loan investors receive priority for repayment in the event of a default over other obligations and before stock or bond holders. Loans also hold a first priority lien on the assets of the borrower, including cash receivables, inventory and property, and plant and equipment.

Figure 6: Recovery Rates

Over the past 15 years, the average recovery rate on loans that default is 70%, meaning that credit losses amount to 30% of the 3% average annual default rate, or about 1%. This implies that 99% (see Figure 6) of principal has been returned to investors over a period that has included a number of recessions, which means almost all the annual income that is generated from a portfolio of loans is retained by investors.

Figure 7: Capital Preservation

Source: Moody’s Investors Service report, February 2016.

Low correlation to other asset classes. Given their floating rate coupon, loans have historically offered a low correlation to the Global Aggregate, which is a longer duration asset class, as the chart below highlights.

Figure 8: 10-Year Correlation

Source: Bloomberg, Barclays. As of December 31, 2016.

Given the significant bull market in fixed income over the past 20 years, fixed rate, long duration instruments have generally performed well. For the 20 years ended December 2016, the yield on 10-year U.S. Treasury fell from 6.3% to 1.8%.* This was an incredible boost for traditional bonds as declining rates pushed up their prices and enhanced total return. This clearly made traditional bonds look more attractive than loans, whose prices are generally unaffected by interest rate changes, from both a return and a Sharpe ratio perspective—see Figure 9.

Figure 9: Returns by Asset Class

January 1997 to October 2016

| Annualized Returns | Standard Deviation of Monthly Returns | Sharpe Ratio | |

|---|---|---|---|

| S&P/LSTA Index | 5.19% | 1.72% | 0.47 |

| BAML HY Master (H0A0) | 7.39% | 2.63% | 0.55 |

| 10-year Treasury (GA10) | 5.58% | 2.12% | 0.43 |

| S&P 500, including dividends (SPX) | 8.49% | 4.42% | 0.40 |

| BAML High-Grade Corp. (C0A0) | 6.20% | 1.53% | 0.72 |

Source: LCD, an offering of S&P Global Market Intelligence, Bank of America Merrill Lynch. As of December 31, 2016.

However, as we reach an inflection point in interest rates, we believe loans could be poised to outperform over the years to come. The lower volatility of the loan asset class has been clearly demonstrated and can be seen above in the standard deviation of monthly returns. In short, we believe that the Sharpe ratio should improve over the coming years as the tailwind from declining interest rates starts to wane.

Conclusion

Since it is difficult to predict exactly when interest rates will rise or their path, we believe the embedded benefits of the loan asset class make a compelling case for a strategic allocation. These positive attributes, which include relatively high current yields, duration and credit protection, as well as a low correlation to other fixed income options, mean a permanent allocation to loans can provide benefits to a variety of investors in any market environment. For insurance companies in particular, senior loans can help support capital profiles both in terms of regulatory impact and through their relative price stability.