Municipal finance has been making headlines in recent weeks beginning with the highly anticipated Puerto Rico default. Within the U.S., several states including Illinois, Connecticut and New Jersey have also been making headlines as they wind up their fiscal review and budgeting process. In the wake of these events, we think it’s timely to address the municipal debt market and in particular how insurance portfolios should consider these risks and opportunities. U.S. insurers have long looked to municipal bonds as a relatively stable source of high-quality yield. Historically, exposure to the asset class has often been treated as little more than an extension of a core fixed income portfolio. However, post-crisis dynamics in the municipal debt market and potential changes in the investment landscape related to infrastructure policy have given rise to new challenges and amplified old ones, suggesting that the asset class demands specialized, dedicated attention.

Weaker-than-expected post-recession GDP growth in the U.S. coupled with government policy shifts related to healthcare have impacted some corners of the U.S. more than others. These market dynamics underscore the need for dedicated municipal debt experts to navigate market opportunities and avoid potential missteps.

Introduction

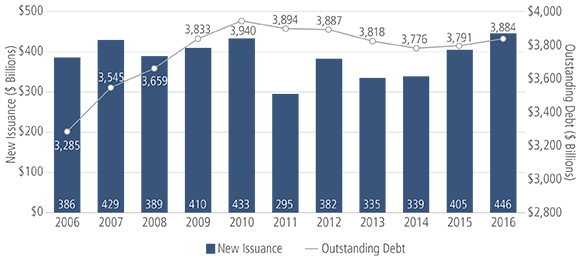

At more than $3.8 trillion, the U.S. municipal bond market is one of the largest sectors within the global fixed income investment universe. Municipals long have been a staple of insurance company portfolios, contributing tax efficiency in the case of P&C companies and providing a source of highly rated duration for life companies to support asset/liability management. As of December 31, 2016, domestic insurance companies held nearly 15% of outstanding municipal debt.1

Insurers including both P&C and Life companies historically have managed their municipal bond exposure in a variety of ways. Some establish in-house management capabilities to oversee their portfolios, while others outsource dedicated municipal bond mandates to third-party investment managers. Interestingly, it remains common for insurers to manage municipal assets as part of an existing core fixed income portfolio, effectively including AA and A-rated municipal debt as part of a broad allocation to investment grade credit. This approach likely is driven by the fact that the municipal market was once largely guaranteed by insurance wrap providers such as Ambac and MBIA. While the municipal market remains highly rated, the removal of the insurance guarantee means that today’s market is truly credit driven; thus, dedicated, independent analysis is critical in security selection and portfolio management. Accessing municipal issuance is another important factor. The municipal broker-dealer marketplace is extremely fragmented, requiring significant resources and relationships to access the whole of municipal new issuance and participate in the vibrant secondary market. A final wrinkle impacting the role municipals play for insurers is the prospect of tax reform, as some proposals currently being floated could negatively impact the municipal bond market.

Figure 1: The Municipal Bond Market Has Grown to Almost $4 Trillion

Source: Securities Industry and Financial Markets Association. SIFMA.org. U.S. Bond Market Issuance and Outstanding, as of 12/31/2016.

The complexity associated with these factors coupled with ongoing dynamics playing out in markets related to low yields and length of credit cycle helps to explain why insurers are taking a fresh look at the role municipal debt can play in their portfolios.