In a world of robo-advisors and undifferentiated passive index investing the ability to connect with clients on a personal level has never been more crucial. Sustainable investing, or SRI, could help. SRI is an area that is seeing strong growth, as investors— particularly Millennials and women—have expressed a consistent interest in tying their values to their portfolios. Importantly, research has shown that attention to environmental, social and governance (ESG) criteria has generally helped company performance, supporting the investment rationale for this promising area.

ESG: A Growing Force in Investing

With origins in the 1960s, the surge in SRI/ESG has been building over the past two decades. Between 1995 and year-end 2015, SRI assets under management in the U.S. grew from $639 billion to more than $8.72 trillion, accounting for one out of every five dollars under professional management. Some 1,002 investment funds incorporate ESG criteria into the investment decision-making process, up from 55 in 1995.1

Millennials on A Mission

Millennials may have fewer investable assets today than their more mature counterparts, but that is changing as they accumulate wealth through their own efforts and potentially from any inheritance from their parents.2 Both as consumers and investors, Millennials show particular interest in working for, buying from and investing in companies that score well on sustainability factors. A 2015 survey found that Millennials are almost twice as likely to invest in companies or funds that target social or environmental outcomes, and are more than twice as likely to exit an investment due to objectionable corporate behavior.3

Women’s ESG Affinity

Women, meanwhile, are also showing strong interest in SRI/ESG. A 2013 high-net-worth survey found that 65% of women feel it is important to consider the positive or negative social, political and/ or environmental impact of the companies in which they invest, compared with 42% of men. And 56% of women reported that they would be willing to trade some performance for investing in companies with a greater positive social impact, compared with 44% of men.4 As women often serve as joint voices or sole decision-makers in the management of household finances, their interest in ESG issues is likely to continue to be a factor in the growth of SRI strategies.

Sustainability: A Positive Factor in Long-Term Returns

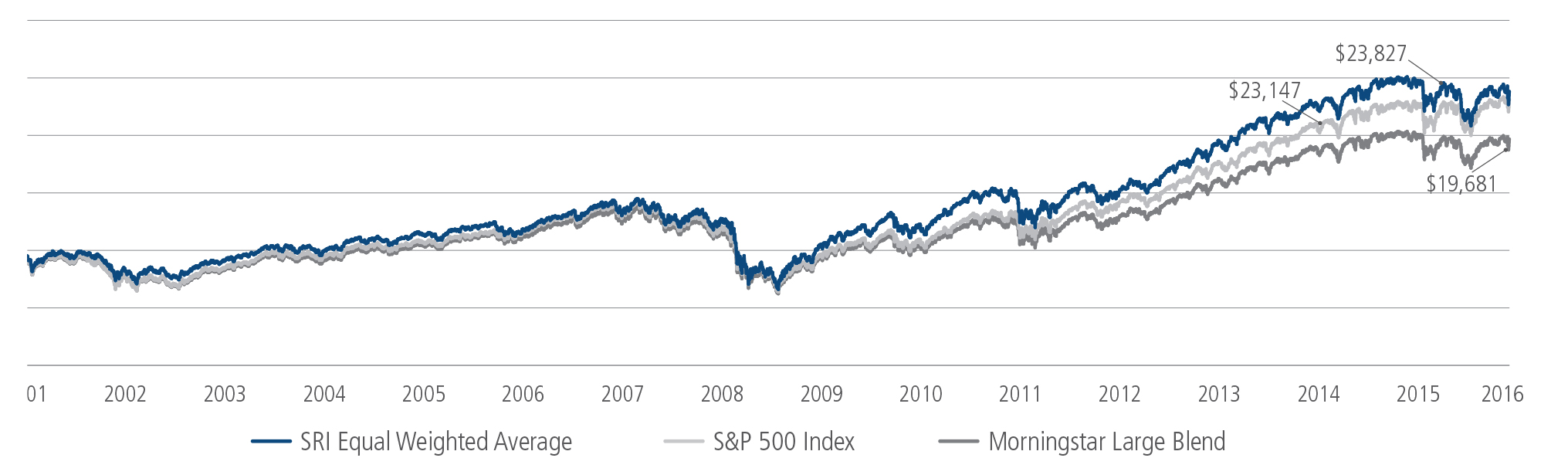

Growth of $10K of All U.S. Actively Managed Socially Responsible Equity Funds versus S&P 500 Index and Peer Average

Source: Morningstar, Forum for Sustainable and Responsible Investment. Data Time Period: 7/1/2001 – 6/31/2016. Indices are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

Performance Points the Way

While sustainability factors do not measure financial performance, there is a growing body of evidence that they can positively impact company results:

- Over a 15-year period, actively managed SRI equity funds in the U.S. generally outperformed their peer group and the S&P 500 on an absolute and risk-adjusted basis (see display).

- Research conducted by MSCI on two higher tracking error global strategies constructed using ESG data over an eight-year period also concluded that it was possible to improve returns on both an absolute and risk-adjusted basis by incorporating ESG factors into the investment process.5

- A 2012 Harvard Business School study found that high-sustainability companies—those that adopt rigorous sustainability policies such as giving the board of directors responsibility for sustainability, tying executive compensation to ESG metrics and auditing and disclosing this non-financial data—outperformed low-sustainability companies on measures of stock market and accounting performance.6

Making the Connection with Clients

Exploring client interest in SRI/ESG could open doors for them, and cement your role as a valued advisor. Given Millennials’ interest in the segment, it also could help solve the intergenerational puzzle—how to extend that relationship beyond your current clients to the broader family. As the universe of SRI products grows, the available choices are likely to increase. Neuberger Berman long has been on the forefront of incorporating ESG factors into the investment process, going back to our first application of “avoidance screens” in the mid-1960s to the launch of our socially responsive investment team in 1989. In our view, the SRI/ESG segment is one in which active managers can particularly distinguish themselves—not just through investment screens but by employing fundamental search criteria that identify companies differentiated by both business prospects and the relevant social/governance factors.

Neuberger Berman offers a Socially Responsive mutual fund and separately managed account. For more information on Socially Responsive Investing please visit www.nb.com/sri.