The success of technology-based companies like Facebook, Netflix and Uber has helped drive consumer expectations to extraordinary heights; today, people want information and services on demand and customized to their specifications. Simultaneously, we are witnessing an increase in demand for expanded product choices as consumers seek to “curate” their lifestyles. In response, an explosion of nontraditional consumer packaged goods brands—which we refer to as “disruptor brands”—are grabbing market share from established category leaders and using their digital savvy to take advantage of next-gen marketing and distribution channels.

The Spice of Life

Supply and demand forces help explain today’s explosion of choice in consumer products. From a supply perspective, dormant domestic manufacturing capacity and the globalization of production mean that access to a supply chain is no longer a barrier to entry. Further, as growth slows for many large, developed companies, the scarcity value of a successful consumer staples start-up has increased significantly. With more large companies on the lookout to acquire growth, the exit opportunity for entrepreneurs today is enticing.

On the demand side, the plethora of consumer review mechanisms means that the cost and error rate of trying a new product has declined, making a broader choice set more accessible. Consumers today can differentiate themselves not just by trading up to a higher price point, but by finding a unique product within the same price point.

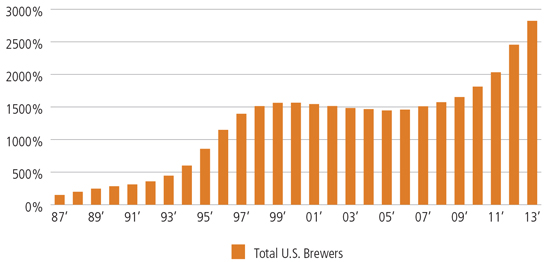

The rise of craft brewers in the U.S. offers a real-world example of these supply and demand forces. The availability of brewing capacity, attractiveness of craft brands to larger brewers and consumers’ desire to try differentiated taste profiles versus the mainstream light lager has fueled significant growth in U.S. brewers. Consumers like this choice and, consequently, the established mainstream beer brands have been losing share.

99 More Bottles of Beer on the Wall

Craft brewers account for much of the rise in the total number of U.S. brewers.

Source: Brewers Association, Jefferies.

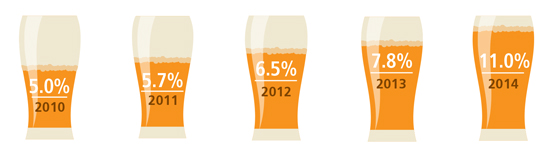

Volume Share for Craft Brewers

Source: Brewers Association.

The Digital World Has Tightened Connections Between Brands and Shoppers, Trend Setters and Opinion Leaders

➊ Brands can “live” online:

A brand can create a “digital habitat” to project its ethos, target its specific consumer cohorts via digital advertising and present interactive content for the consumer.

➋ Brands can sell their products online:

In a physical store, shelf space is limited and often earmarked for the most established, fastest-moving brands with the deepest pockets to entice the retailer to stock their product. In an e-commerce setting, shelf space is unlimited, democratizing the opportunities for smaller and upstart companies.

➌ Brands can listen online:

Digitally enabled innovation is a new concept driving R&D efforts at companies. Increasingly, brand owners can listen to the consumer rhetoric online—see reviews, spot unmet needs and unearth new trends, and then funnel these findings into new ideas.

Outsiders Are In

The rise of nontraditional disruptor brands can be explained in part by the demographic shift underway as the U.S. becomes increasingly multicultural, and millennials, who currently represent approximately 25% of the population, become a dominant force.

Today’s consumers appear more adventurous and willing to try non-mainstream products if they are perceived to offer different, better or more “genuine” results. They are seeking attributes (for example, natural, organic and non-genetically modified) that are harder to find in large packaged goods companies. Many large companies that have built rich margin profiles offering scaled uniform products, meanwhile, are hesitant to change with the consumer. This has opened up traditional products and categories to attack and, to some extent, has promoted an innate distrust of “big companies” who strike the consumer as less genuine than the so-called disruptors.

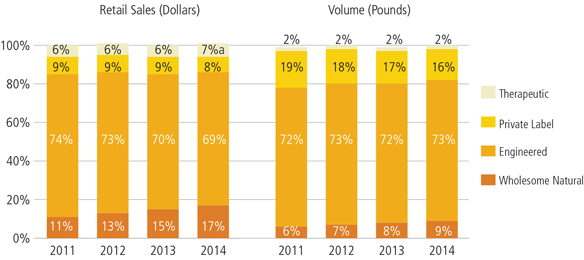

We have seen this phenomenon in the pet food category. More than 60% of households in the United States have a pet and, increasingly, that pet is viewed as a member of the family. As consumers are seeking higher-quality ingredients in their own food, they are increasingly interested in finding those characteristics in their pet food. Seizing on these trends, several “outsider” companies focused exclusively on targeting these families have drawn comparisons between their “wholesome” ingredients and those of the traditional competition and, ultimately, captured a large portion of the category growth over the last several years. Larger competitors that had long dominated the pet food category, meanwhile, have struggled to reform their image to compete effectively, even resorting to buying small, more “authentic” brands to gain exposure to these changing consumer trends.

Nutritional Needs Increasingly Top of Mind for “Pet Parents”

Disruptor brands have capitalized on consumers’ desire for more “wholesome” choices for pets.

Pet Food Retail Sales by Market Segment, United States, Tracked Channels

Source: SEC filings.

Shopping the Digital Aisles

Back in 2006, only 3% of U.S. retail sales were transacted online. In 2015, that number has more than doubled and manufacturers and retailers alike have become vocal on the importance of social media and having a comprehensive e-commerce strategy. Consumers now regularly interact with and make up their minds about brands first and foremost in the digital world. This easier access to consumers can provide an advantage to smaller brands, and is breaking down the traditional barriers to entry on which many large, consumer-oriented companies relied in previous decades.

Even long-established companies have had to adjust their thinking in this brave new world. There used to be a reference to the all-important “first moment of truth” as the manner in which the consumer first experiences a brand on a store shelf and the importance of getting that moment “right.” Now there is a reference to the “the zero moment of truth,” which describes the interaction between the consumer and the brand on computers, smartphones and tablets—long before he or she enters the store.

Consumers and the mediums through which brands reach them have evolved to such an extent that the traditional go-to-market models have lost some traction. Sourcing attractive investment opportunities requires us to sift through significant noise as we seek to understand which established companies are or are not adapting to the rapidly changing consumer landscape and which emerging brands are tapping into an evident consumer need not being met by the established players.