What is Carbon Footprint Analysis?

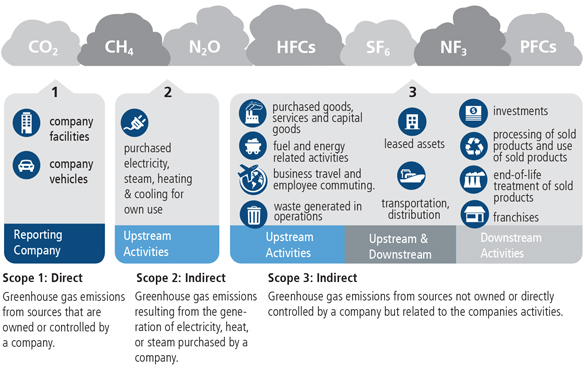

Carbon footprint measures greenhouse gas (GHG) emissions’ intensity, by translating total emissions into a number relative to revenues, employees or other basic characteristics tied to a company. This lets one evaluate the company as it grows over time, and compare it to other businesses of different sizes and in other industries. In theory, a carbon footprint should account for GHG emissions across four categories—carbon dioxide, methane, nitrous oxide and fluorinated gases. The footprint covers not just direct (“scope 1”) emissions but also indirect (“scope 2”) emissions such as those created by an electrical plant the company pays for electricity).

What Are Its Limitations?

We are big fans of carbon data, but we also note its current shortcomings:

- First, there are gaps in the data. Not all companies disclose their scope 1 and scope 2 emissions, or cover all the GHG categories noted above; and the methods outsiders employ to estimate those figures are often unreliable.

- Second, most companies don’t report “scope 3” emissions, which are those created by the customers (whether direct or indirect) of a given company. Emissions figures alone won’t reflect the fact that a company’s products and services enable customers to be more energy efficient.

- Third, emissions intensity does not take into account a company’s business model. For example, a company may appear to have a low carbon footprint simply due to outsourcing of heavily polluting business functions—rather than reflecting a favorable approach to emissions or innovations of any sort.

- Fourth, carbon intensity analysis does not address broader environmental issues. For example, nuclear power may not emit any CO2, but its overall environmental impact is high due to unresolved waste-related issues.

So what’s an investor to do? One thing we feel it is important to avoid is overestimating the usefulness of current carbon data by itself. But we believe another mistake is to discredit such information, as we believe it provides a useful foundation for analysis, as long as other elements, i.e., the broader context (scope 3) in which the company operates, are brought into play. The display below provides a sense of the factors that can go into a thorough assessment of carbon impact.

Getting the Big Picture

GHG Protocol Scopes and Emissions Across the Value Chain

Source: GHG Protocol, 2011.

Carbon Assessment in Portfolios

Our team takes an integrated approach to sustainability. In our view, carbon footprint analysis is just one useful tool among many in helping to identify company emission profiles and associated net benefits and impacts. The current scope of carbon analysis doesn’t incorporate many critical customer and contingent effects. So we favor assessing these issues as part of a broader investment analysis—looking for companies that have demonstrated a commitment to environmental sustainability by minimizing their environmental footprint and/or producing products and services that have a direct and in many cases broad environmental benefits.

Keep in mind that carbon footprint can be measured at the portfolio level as well. So it’s a good way to see if a manager who’s ostensibly focused on environmental, social and governance (ESG) issues is investing consistently with his or her stated parameters. As ESG factors can have a meaningful impact on long-term performance, we believe that carbon analysis can also help assess the prospects of investment managers over the long haul.