Infrastructure expansion has remained a hallmark of the utility sector for many years. Over a century ago, Americans began to use fossil fuels to generate energy at local power plants. Electricity was carried through transmission grids that would power the nation. Power generation technology and the U.S. transmission grid came to be modern marvels of the 20th century, strengthening the country’s competitiveness on the world stage by powering factories, homes and, eventually, many of the advanced technologies enjoyed today.

In the decades after utilities became a widely investable industry, many utilities gradually came to be considered classic “widows and orphans” stocks—investments that tended to provide favorable dividends and steady, relatively predictable growth. Although that perception of stability and income continues, the truth is a bit more intricate and interesting. The sector expanded quite rapidly in its early years, as electric and gas companies connected U.S. communities helping to advance society with necessities such as heating and air conditioning. Over time, it has experienced periods of accelerated earnings growth as companies have focused on infrastructure expansion. Moreover, the type of utility one invests in can have a meaningful impact on investment performance. Today, we believe utilities as a whole are again poised for growth, this time driven by an infrastructure build-out tied to relatively “clean” natural gas as coal generation retires given greenhouse gas regulations. Further enhancing the growth appeal of the sector is the proliferation of renewable energy sources, the expansion and modernization of the power grid, and new opportunities tied to the exportation of liquid natural gas.

In this Insights article, we take a closer look at the U.S. utilities sector, including the different “flavors” of utilities, their growth drivers and risks. Our hope is that we can provide readers with a basic understanding of an increasingly important investment segment that influences a variety of sectors. We consider the longer-term case, taking into account risks such as rising interest rates as well as income appeal and growth associated with infrastructure expansion.

Understanding the Utilities Sector

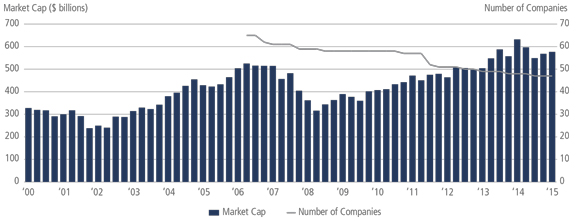

The utilities sector has appealed to total return-oriented investors and can be attractive in a low interest rate environment. Beyond being the most capital-intensive industry in the U.S. and a key input to economic activity, the sector sits at the nexus of a number of key industries, including railways, coal, energy exploration and production, and renewable energy. This highlights the importance of utilities sector fundamentals since key trends can provide valuable insights into other industries, sometimes revealing potential pitfalls and investment opportunities for generalist investors (lower coal usage being a prime example). Utilities represent about 4% of the S&P 500; and electric utility stocks, which make up the vast majority of publicly traded utilities, are valued at roughly $580 billion, including about 60 companies across multiple market-cap ranges. As shown in Figure 1, while the market cap of electric utilities (blue bars) has generally expanded over time, the number of public companies has declined primarily due to acquisitions and consolidation.

Figure 1: Utilities Market Cap and Number of Companies Over Time

Source: Edison Electric Institute. Data through December 31, 2015.

The utilities sector is relatively varied in terms of business models, regulatory jurisdictions and fundamentals. From an investment perspective, the sector can be divided into two main categories, each of which has a different general risk profile.

Regulated: Classic ‘Steady Eddies’

Most of us write monthly checks to our local utility. That utility is typically regulated by a state commission that approves projects and allows a return that the utility can achieve. Therefore, each state’s regulatory environment is of utmost importance to the utilities investor. Regulation doesn’t stop at the state level. Many utilities operate interstate transmission grids, which are subject to federal oversight given the importance of maintaining reliability of the country’s bulk power system. Regulated utilities may be more interest rate sensitive with modest earnings growth; still, these “Steady Eddie” companies often are found appealing because of their earnings visibility, attractive yield profiles, dividend growth potential and defensive attributes in volatile markets. All utilities are not created equal, and some may have higher earnings and dividend growth prospects than others.

Integrated: Raising the Stakes

This subsector is something of a hybrid as integrated utilities have both a regulated earnings base and some “competitive” power generation assets. Competitive generators are unregulated and sell electric power on the wholesale market, where wholesale power prices fluctuate due to supply/demand and weather variability, for instance. As a result, earnings from unregulated operations are potentially more volatile than regulated earnings.

Which sector has performed better? Historically, this has depended on several factors including the commodity cycle (for unregulated generators) and Federal Reserve interest rate policy (for regulated companies, whose dividend yield competes with bonds for investor attention). Over the past 10 years, the more conservative regulated segment has outperformed the more volatile integrated segment, which is to some degree due to the exposure of the latter to ultralow natural gas prices (which set wholesale power prices). Low commodity prices have helped keep bills lower for regulated utilities but have also hampered the profitability of unregulated wholesale generators. Of course, both integrated and regulated utilities overall have benefitted from an accommodative interest rate backdrop. It bears noting, however, that performance trends can shift, and often may be very company- and market-specific.

Figure 2: Risk/Reward of the Main Utilities Segments

10-Year Annualized Return and Standard Deviation through December 31, 2015

Source: FactSet.

Independent Power Producers: Horse of a Different Color

A smaller albeit important segment of the utilities sector is worth mentioning here, the Independent Power Producers (or IPPs). These companies generate earnings entirely from unregulated power sold into the wholesale market (the commodity-sensitive component of integrated utilities explained above). Generally, earnings from these companies can entail greater upside and downside risk given commodity price dependency. To help temper and manage this potential volatility, IPPs tend to sign contracts for some of their power while leaving a component available for spot market sales (how much depends on the IPP company/strategy). Growth potential can be higher in a rising gas/power commodity environment, but IPPs tend to have higher debt levels and carry greater potential risk in a declining commodity market as financial results could trend lower. Indeed, a few of these companies have declared bankruptcy over the last decade, and, in 2015, IPPs greatly underperformed in the wake of commodity price declines. (These stocks have rebounded thus far in 2016.) However, any strength in commodities as well as continued interest in IPPs on the part of private equity investors could improve the investment prospects for this higher beta area. On a positive note, coal retirements have helped improve the supply/demand balance, which may prove beneficial to power prices over time (favorable weather would help as well).

Potential Growth Sources

The trends noted above deal with the past, but what about the future? In thinking about growth prospects, it’s important to remember that for regulated utilities, earnings and earnings growth potential are largely a function of spending and regulators allowing companies to recover costs and earn a “prudent” return on their investment. For example, capital expenditures on new power generation facilities and costs to construct transmission grids may get passed onto customers in the form of higher rates if approved by state and federal regulators. Higher revenue can help a utility company grow its earnings over time, which often translates into dividend growth for shareholders. In today’s marketplace, we see several trends that could power utilities’ growth moving forward, including infrastructure expansion and modernization, vehicle electrification and natural gas exports.

Infrastructure

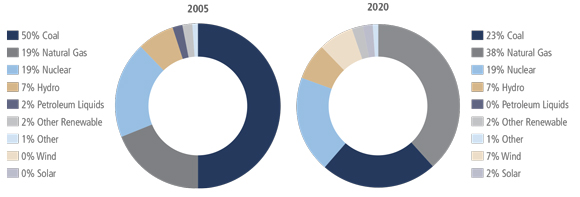

We believe utilities are on the cusp of an extended period of infrastructure growth given the heightened emphasis on cleaner power resources and the increasing emphasis on natural gas as the sector’s “fuel of choice.” In this respect, natural gas is a base load generation leader, as it emits roughly half the CO2 of coal and is also a low-cost option, given prevailing low gas prices. As a result, demand for natural gas remains healthy and is expected to rise to around 30 Bcf/d (billion cubic feet per day) from 25 Bcf/d just five years ago. As more coal-fired generation facilities and nuclear power plants are retired, gas demand should increase even further, leading to increased opportunities to enhance gas infrastructure including pipelines, gas-fueled power facilities and more transmission.

Figure 3: Power Sources for Utilities - Natural Gas and Alternatives Are Expected to Gain Ground

Source: EIA and Neuberger Berman estimates.

Another key infrastructure growth driver is the basic need for upgrading and modernizing transmission networks. The U.S. century-old power grid is in desperate need of upgrading and expansions are increasingly important to deliver renewable power resources to end users. Federal and state policies are requiring significant upgrades to transform the grid into a “smarter” electric superhighway of the 21st century.

Moreover, the threat of terrorist and cyber-attacks that could compromise the country’s largest cities and defense systems has grown and is also requiring changes to power infrastructure to address these issues. Costs of implementing projects like these could also be placed in rates and afford companies another avenue of earnings growth to help ensure power reliability.

Vehicle Electrification

Beyond basic economic and housing sector fundamentals, long-term growth in electricity demand may be increasingly dependent on electric vehicles, which could be a “game changer” for the industry. Emissions standards and advances in technology are helping to propel the popularity and viability of such vehicles. If a major market such as the United States or China embraced electric cars, it could provide a large tailwind for the power industry, as many charging stations would likely draw power from electric plants. Some of this demand may also be tempered by energy efficiency measures (i.e., more efficient lighting and appliances), which remain an ongoing sector trend.

Natural Gas Exports

The low cost of natural gas is contributing to the globalization of the industry in the form of Liquefied Natural Gas (LNG) exports. To capitalize, a handful of utilities with gas operations are in the process of converting their LNG import facilities to allow LNG exportation. Select utilities involved with LNG exports seek to avoid commodity exposure and are paid “tolls” by customers to run gas through the liquefactions plant. Such a strategy provides another avenue for earnings growth without taking undue commodity risk (although counterparty risk is a possibility).

What We Find Appealing

Finding an attractive utility is a complicated task and there is sometimes a significant dispersion of performance among utilities. We tend to like utilities that operate in faster-growing states with favorable regulatory frameworks, and that are also are guided by proven shareholder-friendly leadership teams. Key fundamental indicators include stronger-than-average infrastructure growth potential (including power and natural gas) as well as below-average dividend payout ratios, which may suggest the potential for above-average dividend growth prospects. In our view, an investment based solely on a high yield can prove to be a very risky proposition. We tend not to like companies with high payout ratios, especially if our analysis suggests a dividend reduction appears likely. Given general consolidation trends, we also believe strong fundamentals and balanced state regulatory jurisdictions may make certain smaller companies more attractive as acquisitions, and help fuel the growth of the acquirers.

Balancing Risk and Reward

Despite the positives mentioned here, utilities clearly have risks. At times, the sector can (like others) be prone to overvaluation. Meanwhile, utilities’ reputation as “bond proxies” can make the group vulnerable during periods of rising interest rates. Other risks include regulatory uncertainty, project delays and sector rotation into higher growth-oriented investments. That said, we also believe utilities have attractive and sometimes underappreciated opportunities, as they are leading the transition to cleaner fuels while benefiting from infrastructure upgrades and expansions that fuel earnings growth. In addition, the group continues to offer the appeal of competitive yields and dividend growth potential, as well as lower historical volatility relative to the broad market. All told, these historically significant stocks retain their defensive attributes but are also providing signs that some excitement may still lie ahead.

Utilities Have Generally Provided Favorable Risk/Return, Coupled with Sizable Yield

| 10-Year Return | Annulized Return (%) | Standard Deviation (%) | Current Yield (%) |

|---|---|---|---|

| S&P Utility Index | 7.41 | 13.61 | 3.5 |

| Barclays Int G/C Bond Index | 4.04 | 2.79 | 1.8 |

| S&P 500 Index | 7.38 | 15.00 | 2.2 |

Source: Bloomberg. Data as of December 31, 2015.