Investment Strategies

>

Equity Income

Equity Income

An all-cap active strategy with a focus on growth of capital, income generation and downside risk mitigation

- Strategic allocation across REITs, Utilities, Convertibles and other high-yielding securities

- Differentiated bottom-up approach to security selection focused on discounted free cash flow and net asset value

- Senior portfolio managers average over 30 years of industry experience

Sandy Pomeroy

Senior Portfolio Manager

Richard S. Levine

Senior Portfolio Manager

William D. Hunter

Portfolio Manager

Shawn Trudeau, CFA

Portfolio Manager

Overview

Investment Philosophy

- We avoid consensus thinking

- Long-term value can be created by the companies we believe are attractively priced and poised to benefit from significant and underappreciated global trends

- Opportunistic investment in non-U.S. companies seeks to improve the portfolio's risk/return profile

- On-site company visits (globally) are a key component of the investment process and can meaningfully inform portfolio positioning

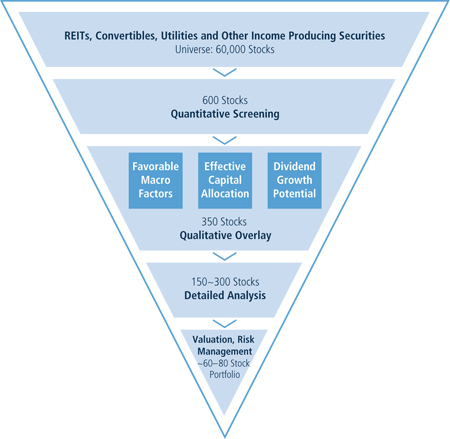

Investment Process

Employs a top-down identification of global secular growth trends/themes and a bottom-up approach to security selection focused on discounted free cash flow and net asset value

REITs, Convertibles, Utilities and Other Income Producing Securities

Universe: 60,000 StocksQuantitative Screening

600 Stocks- Fundamental Analysis

1. Market Cap > $1 billion

2. Daily Turnover > $5mm

3. Dividend yield > S&P 500 Index

4. Total debt < market cap

5. FCF Yield > 5%

Detailed Analysis

150–300 Stocks- Fundamental Research

- Meet with 800+ companies/year

- Maintain models on 300+ companies

- Discounted free cash flow analysis to avoid overpaying for stocks

Valuation, Risk Management

∼60–80 Stock Portfolio- Portfolio Construction

- Valuation

- Weighting determined

- Risk management

- Continuous monitoring

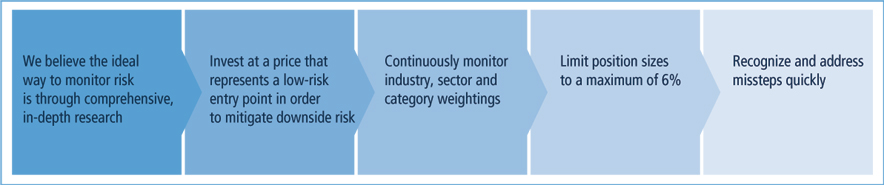

A Commitment to Risk Management

- Asset class diversification

- Income component has been shown to potentially dampen volatility

- Typical individual security exposure of 2%, maximum of 6%

- Automatic review if stock has dropped 20% from its cost

Management

Sandy Pomeroy

Senior Portfolio Manager

43

Years of Industry Experience

20

Years with Neuberger Berman

Richard S. Levine

Senior Portfolio Manager

47

Years of Industry Experience

36

Years with Neuberger Berman

William D. Hunter

Portfolio Manager

25

Years of Industry Experience

19

Years with Neuberger Berman

Shawn Trudeau, CFA

Portfolio Manager

19

Years of Industry Experience

14

Years with Neuberger Berman