Small Cap

A research-intensive strategy with a long-term perspective seeking to identify high-quality, attractively-valued companies with stable, modest growth prospects

- Quality focus seeks to mitigate common risks associated with small-cap investing

- Patient, long-term investors with low turnover investing style

- Adhere to a quality approach in all market environments, even during periods where lower quality companies outperform

- Has historically provided downside risk mitigation in declining markets, while lagging in strong, rising markets

- Experienced team of nine dedicated, small-cap professionals led by Co-Portfolio Managers Judith Vale and Robert D'Alelio, who have over 30 years of industry experience

Overview

Investment Philosophy

We look for growing, financially strong small-cap companies that are often mispriced due to a lack of analyst research coverage, coupled with investors' obsession with short-term time horizons. As disciplined, experienced small-cap investors, we believe that Wall Street's tendency to focus on short-term earnings trends presents opportunities to identify and invest in high-quality, growing businesses at attractive prices.

We seek to build a diversified portfolio of companies with the following characteristics:

- Strong balance sheets

- High returns on assets, protected by competitive barriers to entry

- Excess cash flow generation, which can self-fund growth

- Above-average growth with below-average volatility

- Valuations at or below the small-cap market (Russell 2000 Index)

We tend to avoid:

- Pure commodity businesses

- Highly volatile businesses

- Short cycle businesses (either economic or product)

- Start-up businesses (short operating histories)

Investment Process

Our bottom-up investment process primarily focuses on identifying quality businesses in which we would like to invest, typically over a three- to five-year time horizon. We concentrate our efforts on "big fish in small ponds" — companies that dominate niche markets and have the potential to extend their franchises into related businesses.

Financial and Fundamental Analysis

We employ rigorous financial and fundamental analysis to determine whether or not profit and loss statements (P&L) have been manipulated; if cash flows are deteriorating; or growth is slowing.

Top-Down Viewpoint

In addition to our bottom-up approach, we also overlay a top-down viewpoint that guides portfolio positioning. We are not averse to overweighting particular market sectors for extended periods if we determine that a secular demand trend is firmly in place.

In-Depth Research

We seek to identify sustainable quality with a focus on:

- Strong free cash flow generation which can make firms less capital market dependent

- Superior return on assets supported by competitive barriers to entry

- Less volatility and less economic sensitivity with generally strong balance sheets

- Consistent, above-average growth rates, sustainable over the intermediate and long term

Over the Long Term, Company Fundamentals Tend to Prevail

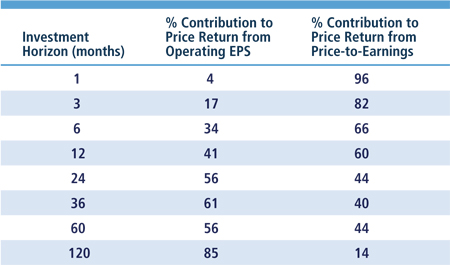

*Sources: Beacon Pointe Advisors, RBC Capital Markets Research. Based on Thompson estimates for the S&P 500 Index. For illustrative purposes only, S&P 500 Index data is being presented given the limitations on availability of comparable data for small-cap indexes. The portfolio management team's believe the results of this analysis are also relevant for small-capitalization stocks.

In our view, active managers in the small-cap space can benefit by avoiding short-term speculative choices in favor of a long-term time horizon tied to underlying fundamentals.

Returns Attributable to Valuation and Earnings Change – S&P 500 1956-2012*

Over an investment horizon of 120 months, earnings – not valuations – were the key driver of return, accounting for 85% of the movement in stock prices.

- We have found that above average, sustainable growth can often be found in unexciting businesses that routinely generate and redeploy free cash flow to the advantage of patient owners. Conversely, many of the exciting small-cap growth stories that attract so many investors also attract competition, and often dilute shareholder returns via equity issuance.

- This presents an attractive opportunity for long-term oriented active managers in the small-cap space.