Overview

Investment Philosophy

We believe that individual security selection drives performance potential in the municipal bond marketplace

- Our approach focuses on a bottom-up analysis of individual securities

- Independent and experienced credit research team

- Veteran portfolio managers make relative value judgments based on market outlook and proprietary research - Ongoing dialogue between portfolio managers and analysts over market opportunities

- Portfolio returns can further be enhanced by:

- Curve management

- Opportunistic trading

- Duration control

- Forward looking proprietary research - Assessing the ESG considerations of the Issuer is integrated into the standard credit analysis framework

Investment Process

We believe our key areas of value add are:

Commitment to Research and Risk ManagementOur investment process utilizes proprietary technical and fundamental models to assess structure, credit and relative value. In addition, we seek to control risk in clients’ portfolios through a disciplined credit research process and prudent levels of diversification in terms of issuer, sector, and when possible, geographic location. Constant communication between the research and portfolio management teams is fundamental to our risk management effort. |

Portfolio CustomizationIndividual portfolios are constructed for the income and liquidity needs of each investor. We have long-term relationships with over 80 regional broker/dealers which help us access high quality securities which we purchase at institutional prices on behalf of our investors. |

Liquidity to Meet Client RequirementsDepending on the strategy chosen, a cash management client may have all or a portion of their account invested in variable rate demand obligations (“VRDOs”). Given that the securities typically have a feature that allows them to be put at par (100%) in either one or five business days, they provide our clients with a source of liquidity to meet their cash requirements. |

The Value of Active Credit Decisions

Our credit research and active management seeks to avoid potential downgrades

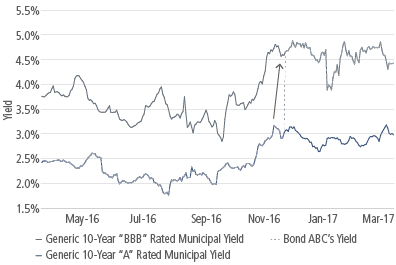

- A bond’s yield reflects its perceived risk and liquidity

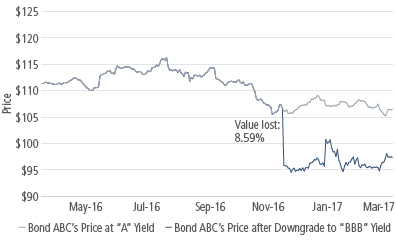

- When a bond experiences an erosion in credit, the market demands a higher yield to reflect the increased risk

- The graph at the left depicts generic “A-rated” and “BBB-rated” bond yields over the last few months, as well as the yield path of Bond ABC that was downgraded from “A” to “BBB”

- The graph at the right depicts the change in Bond ABC’s price that results from the change in yield

Rating Downgrade Causes Bond ABC’s Yield to Rise…

Bond ABC's Yield Path

Source: Bloomberg

And Its Price to Decline…

Bond ABC's Price Path

Source: Bloomberg

Note: For illustrative purposes only. The above charts are intended to reflect a hypothetical impact of a ratings downgrade on corresponding yields and price. It is not intended to reflect information related to any specific security and actual results could differ.