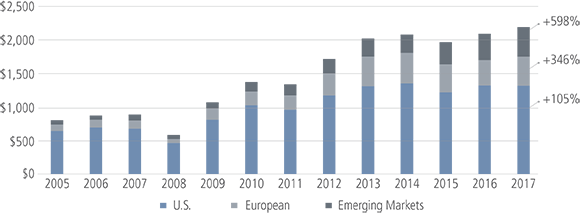

It is not all that long ago that “investing in high yield” effectively meant “investing in U.S. high yield”. The rapid growth of these markets in Europe and the emerging world, however, makes it difficult to sustain this assumption. The size of the European market was less than $100bn back in 2005 and is now more than four times that size. Emerging market high yield has rocketed from just $60bn in 2005 to nearly $450bn today. Together they represent more than a third of the global high yield universe.

However, while the case for going global with a high yield allocation could easily be made by simple reference to the size and growth of European and emerging markets today, the deeper argument takes into account the added industrial-sector balance, the entirely new source of diversification and alpha introduced by country-of-issuer risk, and the better-quality credit fundamentals found in these markets.

Maintaining a U.S. high yield allocation may be a perfectly reasonable thing to do, of course. Many investors will continue to do just that. However, the assumption that a U.S. allocation is effectively a global allocation that brings all of the same potential benefits no longer stands up to serious scrutiny. We believe that the time has come for high yield investing to go truly global.

Figure 1. From a Low Base, European and Emerging High Yield Markets Are Growing Fast

Source: Bank of America Merrill Lynch. Universe represented by the Bank of America Merrill Lynch Global High Yield Index. Emerging markets defined as issuers with a country of risk other than an FX-G10 member, a Western European nation, or a territory of the U.S. or a Western European nation. U.S. represents non-EM USD HY bonds. European represents European currency HY bonds. Data as of December 31, 2017.