Options strategies have traditionally been seen in one of two ways: as a means of hedging risk or achieving income via an existing position in stocks or bonds, or as a vehicle for speculation. However, investors are increasingly looking at options through a third lens: as a less volatile approach to maintaining equity exposure.

A classic use of options looks something like this: Assume that you own 100 shares in stock A, which has had a long successful run and is currently priced at $50. However, now you believe it may be facing a period of increased volatility. For a premium, you might buy an option giving you the right to sell the stock (a “put”) at $48, locking in much of your gain over the tenure of the option. If you are skeptical about prospects for the stock, or dislike the economics of the put option purchase, you might also sell a “call” on the stock (a covered call, as you own the underlying security) giving someone else the right to buy it at $52. With this combination, you’ve traded upside in the stock for downside protection in what’s known as a collar.

Options are also commonly used to generate income for a portfolio. Depending how you feel about a given holding, you might sell a call or a put (in the latter case taking on the buyer’s downside risk). If the stock does not reach the option strike (or preset sale) price, it expires worthless and you pocket the premium. Otherwise, the buyer of the option will exercise and you will be forced to follow through on your obligation to either buy or sell the stock.

Beyond these basic arrangements, the world of options can become increasingly complex, esoteric and often speculative, depending on the level of collateral required in margin accounts. In the public mind, it’s a world largely inhabited by a spectrum including aggressive gamblers and hucksters peddling sure-fire options strategies to pliable television watchers.

However, between the two extremes of conservative risk management/income techniques on the one hand and speculative excess on the other is a significant array of practical techniques used to define and trade risk, whether by companies seeking to offset economic or interest rate exposures or investors using systematic techniques to provide additional sources of risk-adjusted total return. It is in this latter category that enduring option-writing strategies are becoming more prominent.

Multiple Concerns Spur Option Investing

The interest in options investing is arising for various reasons. Many investors are concerned about equity and fixed income market valuations, and are therefore looking to reduce their exposure while seeking to retain some of the upside potential of traditional long investing. There is a sense that traditional “low volatility” equities, such as utilities and high dividend stocks, may be more vulnerable as interest rates rise. At the same time, there is some frustration with hedge funds, which previously would have been looked toward to achieve diversification goals but have experienced a difficult environment over the last couple of years.

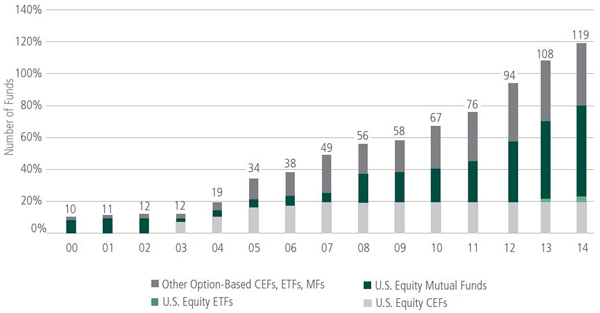

Regardless, the use of options in both mainstream strategies and dedicated portfolios is growing. For example, the number of options-based mutual funds has expanded, from under a dozen in 2000 to some 119 at the end of 2014 (see display). And earlier this year, Morningstar introduced a new option fund category with 42 funds and $23.9 billion in assets under management as of August 31, 2016.

Growth of Options-Based Mutual Funds

Source: Keith Black and Edward Szado, “Performance Analysis of Options-Based Equity Mutual Funds, CEFs and ETFs,” INGARM, January 2015. Figures as of December of the relevant year.

The funds within the Morningstar category all “use options as a significant and consistent part of their overall investment strategy.”1 Beyond that criterion, they vary considerably, with options often complementing a more dominant approach, such as equity stock-picking, or options being used to implement tactical directional market exposures. Moreover, the options strategies employed cover the gamut, from covered call and put writing, to option spreads, options-based hedged equity, and collars.

That said, of all these areas, option writing appears to be gaining the most traction among risk-minded investors, given the availability of standardized benchmarks around which to construct portfolios that can be transparent, liquid, unleveraged and cost-effective. And although covered call-writing has been a dominant choice, given its general reputation as a low-risk strategy, collateralized put writing is starting to get more notice based on its attractive historical risk-return fundamentals.

Know Your Writes

Let’s look at the CBOE S&P 500 PutWrite Index. Introduced in 2007 by the Chicago Board Options Exchange, the PutWrite index tracks a hypothetical portfolio that every month sells one-month “at the money” put options on the S&P 500 Index, fully backed by short-term Treasuries as collateral. The index then sells another one-month “at the money” S&P 500 put when the prior put option expires. Simply stated, the index collects option premiums 12 times per year to generate return. The initial investment amount and all net premiums are invested in short-term Treasuries. The index is fully collateralized and unlevered.

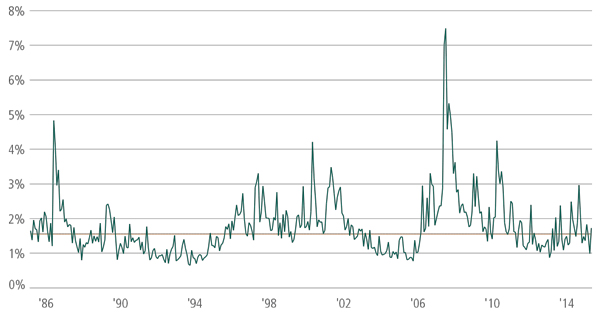

This relatively simple but graceful approach to option indexing is meant to capture the premiums paid for equity and volatility risk that many investors seek to eliminate from their portfolios. It doesn’t go for homeruns, but for many singles. And with a historical median monthly put option yield of over 1.5% for the last 30 years (see below), that would have resulted in an annual return of 18% had none of the options been exercised. Note that actual returns of the index are significantly lower, because the premiums are partially offset by the cost incurred in cases where options are exercised.

Not Homeruns, but Many Singles

S&P 500 30-Day At-The-Money Put Option Premiums

Source: CBOE and Bloomberg, data through September 2016. Put option premiums are based on the underlying option data used in the calculation of the CBOE S&P 500 PutWrite Index, which incepted in June 2007 with historical backtested data available from CBOE since June 30, 1986. Premium yields are calculated as the option premium divided by the option strike price. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

Are those who purchase puts overpaying? It’s really a matter of time horizon. In the short run, there are many reasons an investor may buy puts—namely “insuring” a portfolio, staying within guidelines, or offsetting a margin call, to name a few. However, in the long run, consistent buying of put options is prohibitively expensive. If it were cheap, wouldn’t everyone do it? As there is great demand from investors who want to define their downside risk, the ratio of puts to calls in the marketplace is quite high—about 1.7 since 2005. Moreover, buyers of puts tend to pay more than buyers of calls, roughly 1.6 times more per unit of risk. In other words, the market charges more for loss avoidance.

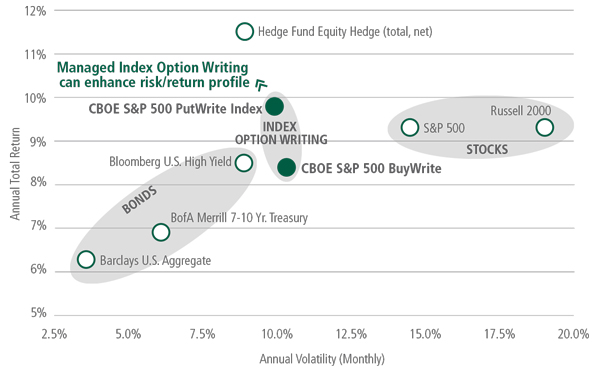

What are the return characteristics, then, of the PutWrite index? Backtested by the CBOE to 1986, the benchmark has provided a return that is slightly higher than the S&P 500 on an annualized basis, underperforming in very strong markets, participating in more moderate gains and outperforming (declining less) during periods of major weakness. The key risk associated with selling puts is that you may have to buy shares at an inflated price during times of market stress, but the offset is a continual stream of options premiums, which actually increase amid volatility. The net result has been equity exposure with much less volatility than the equity index. Given its structural advantages, the CBOE S&P 500 PutWrite Index has also enjoyed outperformance versus the CBOE S&P 500 BuyWrite Index, a similarly structured index which tracks returns on the sale of at-the-money calls, collateralized by holdings in the S&P 500.2

Option Writing Offers Strong Risk/Reward Relationship

January 1990 - September 2016

Source: Bloomberg. Selected time period reflects longest common history of indexes. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

Implementation

In our view, the addition of options writing (and particularly collateralized put writing) strategies could have real benefits to portfolios in terms of smoothing volatility and managing equity risk at a challenging time. For interested investors, there are various ways to access these strategies. There are some passive vehicles available that mimic the PutWrite, BuyWrite and other benchmarks. However, there are also strategies out there that take the index processes and seek to enhance them, for example by altering the collateral used, selling options with somewhat different maturities or seeking to capitalize on better “rolling” of option contracts. It goes without saying that such active enhancements are only as effective as the manager who implements the strategy, so due diligence is crucial.